Dr. Sarod Khandkar thinks that people often decide to invest without knowing or doing proper research. It turns out that they will not be doing good financially.

He offers some advice on getting a home loan. The first thing to do is to see if the company that is paying the loan is an established financial institution.

Secondly, whether the loan interest rate is fixed or variable. In this case, it should be kept in mind that the Reserve Bank may reduce the cash rate. Therefore, taking a loan at variable rate would be the right decision for the borrower. They will have the benefit of lowering the interest rate of the Reserve Bank.

Thirdly, you should try to get a bank loan at a standard rate. However, in this case banks or financial institutions will ask for the correct papers. Dr Sarod advises the borrowers to be careful in refinancing, as the financial institutions from which they borrowed may have opportunities to negotiate with them, and being with the company for a long time also means some of the original loan has already been paid off. Before joining the other lender, the borrower needs to consider what would be the loan period. Failure to make the right decision can result in financial loss.

Dr Sarod advises the borrowers to be careful in refinancing, as the financial institutions from which they borrowed may have opportunities to negotiate with them, and being with the company for a long time also means some of the original loan has already been paid off. Before joining the other lender, the borrower needs to consider what would be the loan period. Failure to make the right decision can result in financial loss.

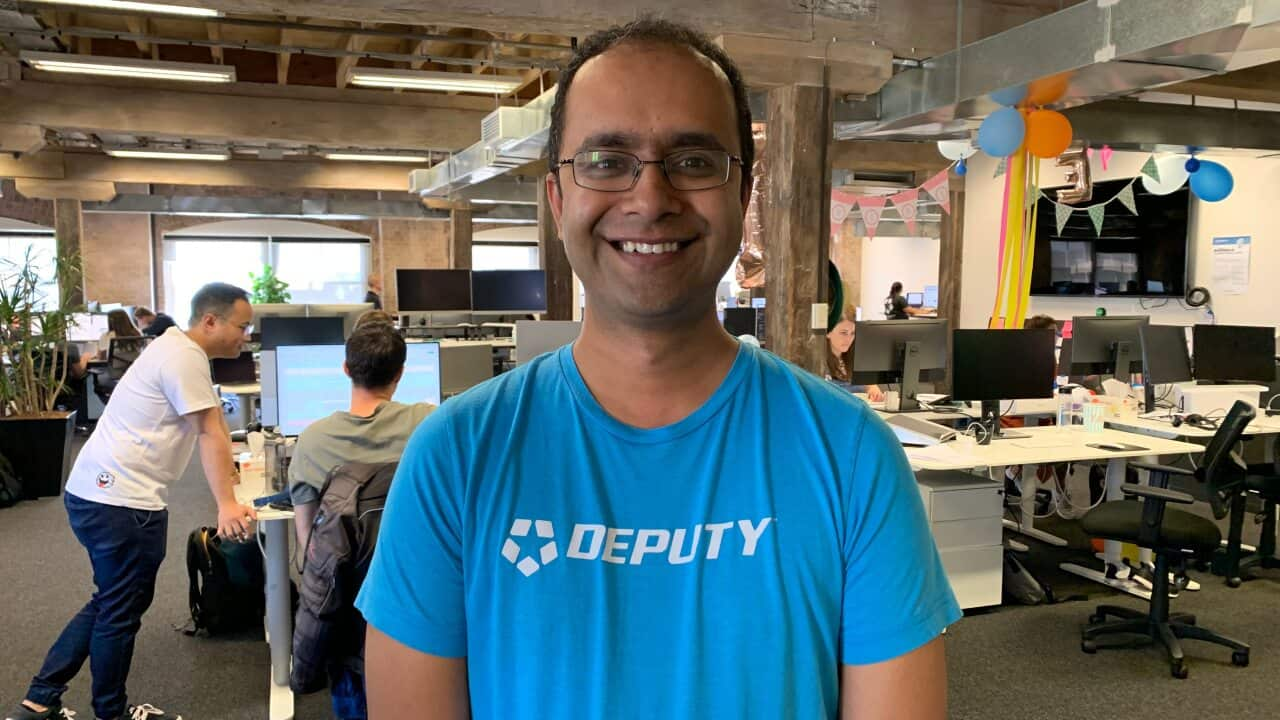

Dr Sarod Khandaker Source: Dr Sarod Khandaker/Facebook

Dr. Sarod Khandaker says, it is important not to be tempted by the so-called "honeymoon" loans, but rather to see the company's comparison rate whether how higher than the interest rates. In determining the comparison rate, banks put other hidden charges on top of their interest rates.

"A bank might show you lower interest rates, but a comparison rate will show higher." So it is very important to understand the comparison rate of the lenders.

When someone is investing in a property, Dr Sarod feels it is very important to understand the equity. Having equity will put someone in a position to invest in a new property.

He thinks budgeting should be smart when it comes to personal finance. In each case of investment, budgeting will create a clear picture of financial transactions.

"Because financial institutions will take into account the financial transactions of the borrower (cash in flow - out flow) when it comes to lending," he says. Therefore, he advises everyone to save a certain amount of money every month when considering the their budgeting.

Dr Sarod insists on considering the focus on good and bad loans. Loans that will not be invested or cash out are bad loans, such as credit cards, holiday loans, etc. And the loan which will be invested and the money returned are good loans; such as investment home loans, business loans, etc. Therefore, he thinks these issues are important in having a loan.

For any investment, Dr. Sarod Khandaker advises to better understand budgeting, cash inflow - outflow, interest rates and terms of financial institutions.

Listen the conversation by clicking the player above