Key Points

- Many individuals, like nurse Nancy Manalastas, face challenges in saving for a house due to high inflation and interest rates, leading to prolonged renting

- Federal Greens criticize $10B Housing Future Fund and argue against tax cuts benefiting the wealthy in the budget

- Adjustments Needed After Relocating to Cheaper Rental, Impacting Groceries and Commute

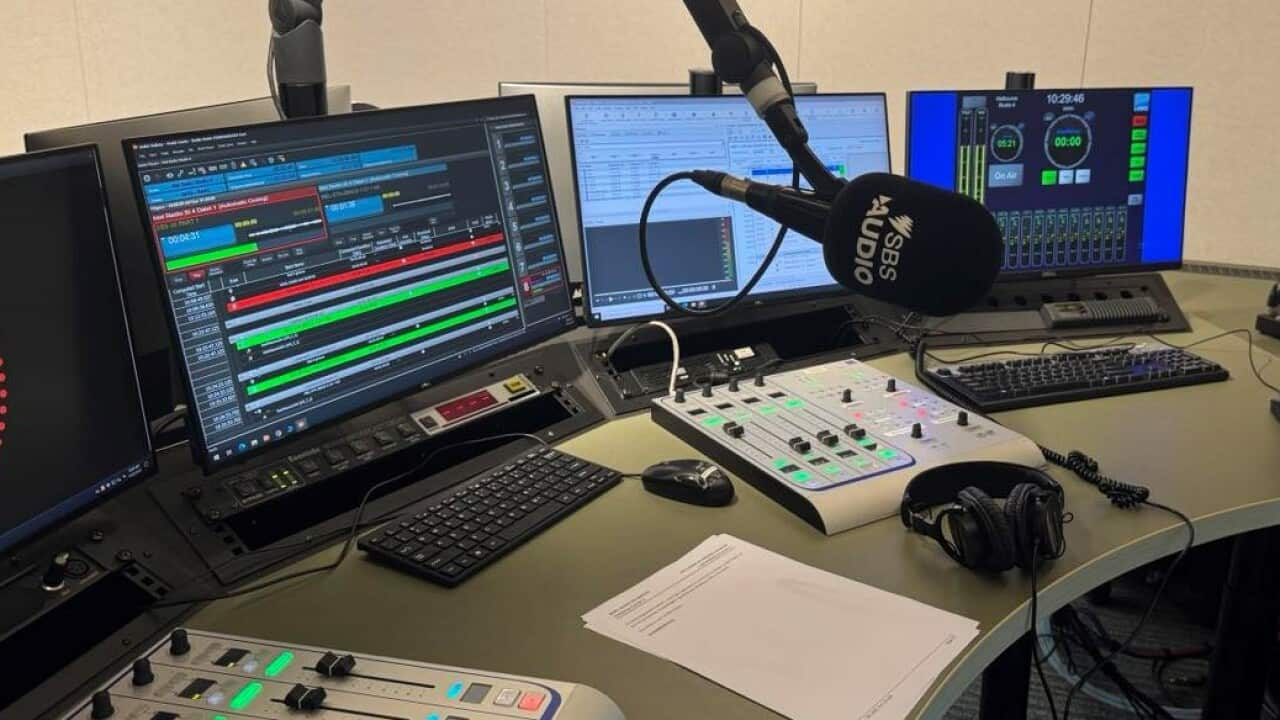

Many people here in Australia are eagerly awaiting the announcement of the Federal Budget tonight.

Source: AAP

According to research from property data firm CoreLogic, rents have increased by 2.5% in the first three months of 2023.

Based on CoreLogic's data, the Power Housing Australia report reveals that weekly rent rose from $440 in January to $577 in April.

Rental crisis deepens in Sydney. Source: Getty / Getty Image

Even homeowners are facing the challenge of increasing mortgage repayments due to consecutive interest rate hikes. The prices of properties have also risen, posing a hurdle for those aspiring to buy a home.

This problem is seen as an obstacle to the dream of nurse Nancy Manalastas to own a house.

"Right now, nag-iipon kami para sa bahay kasi dapat last year pa o two years before nag-iisip na kami na bumili ng bahay pero dahil nga sa naging, nagkaroon ng inflation mataas lahat, pati 'yung interest 'di ba, nagtaasan na rin hindi kami makaka-afford makabili ng bahay so hanggang ngayon nagrerent pa rin kami.'"

[["Right now, we are saving for a house because we should have started thinking about buying one last year or two years ago. But due to the inflation that occurred, everything became expensive, including the interest rates, right? They increased, and we can't afford to buy a house. So, until now, we are still renting,]]

NANCY MANLASTAS PHOTO Credit: NANCY MANALASTAS

"Dati, last year nasa ano kami nasa, $620. So tumaas lahat ng bilihin, ang ginawa namin, lumipat kami sa mas cheaper na nao na rent na naging $380. Ahhm sa ngayon kung dalawa kayo ng nagtatrabaho okay lang, kaya naman pero kung mag-isa ka lang, medyo mabigat yung $380."

[["Before, last year, we were staying in a place that cost $620. Then, the prices of everything increased, so we decided to move to a cheaper rental place, which became $380. Ahhm, if you and another person are working, it's okay, we can manage, but if you're alone, the $380 is a bit heavy."]]

However, they also face significant adjustments after moving to a house with a cheaper rent.

"Number one 'yung ano, yung sa groceries, mas kaunti ngayon. For example 'yung per week one hundred 'yung budget namin ,mas konti ngayon yung nabibili namin compare dati. tapos sa layo din na kung saan ka naglipat na mas mura, usually yung mga murang rent medyo malayo siya sa station malayo sya sa City. 'Yung travel time mo to work din mas longer at saka 'yung padala sa Pilipinas diba. medyo babawaan natin ng kaunti kasi lahat dito nag taas. kailangang mag adjust-adjust din saka yung saving mas mababa yung nacocontribute namin ngayon compare last year."

[["Number one is groceries. We can buy fewer now. For example, our budget per week used to be one hundred, but now we can buy less compared to before. Also, the place where you moved to, which is cheaper, is usually far. Usually, places with lower rent are a bit far from the station and the city. Your travel time to work is longer, and sending money to the Philippines, right? We need to reduce it slightly because prices have increased here. We need to make adjustments, and our savings contribute less now compared to last year."]]

NANCY MANALASTAS PHOTO Credit: NANCY MANLASTAS

"Maganda 'yon kasi mas makaka-save kami ng more, tapos ma aafford namin yung bahay na gusto namin. Hopefully 'yung interest bumaba rin."

[["That's great because we will be able to save more, and then we can afford the house we want. Hopefully, the interest rates will also decrease."]]

Adam Bandt, the leader of the Federal Greens, previously expressed his desire to see the government's response to this crisis. He emphasized the need to allocate a significant budget for housing ahead of the expected Federal Budget tonight.

They are also calling for a national rent freeze.

The Federal Greens continues to oppose the Labor Party's $10 billion Housing Future Fund, which aims to provide 30,000 new social and affordable housing properties within five years.

Bandt stated that the funding is currently not supported by the Federal Greens, but he mentioned that it could be negotiated.

"There's not a guaranteed dollar that's going to be spent on housing. If the fund loses money like it did last year, then there is no money spent on public housing, even if the fund comes into effect, you won't see a single house built before the next Federal Election and at the end of the fund, the waiting list is going to be longer than it is now. We have made it very clear to the Government we are up for negotiation and the ball is in the Government's court." , - Adam Bandth.

For Senator Jordon Steele-John of the Green Party, the $10 billion is not enough.

He stated that the Housing Future Fund seems like a government gamble in the stock market to make money for housing.

The Federal Greens stated that the government is wasting money by continuing with what they call the "Stage Three Tax Cuts" in this budget.

They said that the wealthy individuals are the ones benefiting the most from this budget.

LISTEN TO

Anticipation Mounts as Australia Awaits Federal Budget Announcement amid Growing Housing Expense Concerns

05:24