Highlights

- No taxes for annual income 23,000 and below.

- Take note of Medicare levy exemption and extra income.

- The ATO offers practical advice to first-time taxpayers.

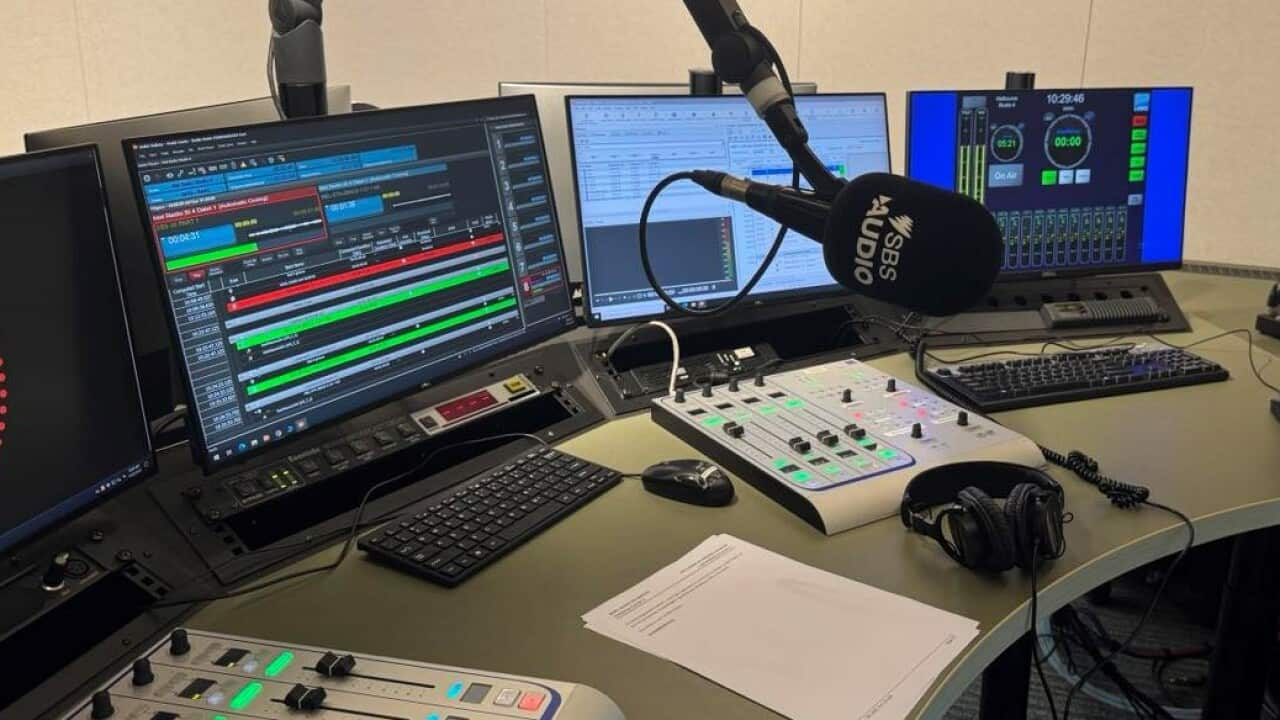

'May PERAan' is SBS Filipino's podcast series featuring financial experts seeking to answer the most common questions about money and finances.

"For first-time tax payers, don't forget the small details when filing because the small details can lead to big refunds."

Accountant Mark Vecino discusses the small details often overlooked.

1. No taxes this year for annual income of $23,000 and below.

"Anything deducted from you will be returned - 100 per cent. The salary threshold is dependent on the national budget," Mark shares.

He adds that typically this would be the case for those earning $20,000 and below; but due to the pandemic, the government has extended the exemption to those earning a bit more.

"In Australia, tax refund is upfront. You receive it as money and isn't returned to you in another form. The good news is that due to the pandemic, the government reduced the tax brackets - meaning, you can expect to receive more tax refunds this year."

2. Non-residents should get a Medicare levy exemption.

"If you're earning, you're automatically charged a . However, as a non-resident paying taxes and not being eligible for Medicare, make sure you're not being charged for it. Let ATO [Australian Taxation Office] know that you shouldn't be charged."

Mark shares that non-residents should attend to this first before filing.

"It's just a matter of filling up a Medicare entitlement statement form from the Services Australia or ATO website. After you fill up the form, just send it to the ATO along with certified copies of your passport and visa. ATO will then give you a certification that you shouldn't be charged for a Medicare levy."

3. Extra income should be accounted for.

"This includes interest, dividends and side-line hustles. Self-filers often forget these."

Mark shares that the determination of whether a side-line hustle should be accounted for when it comes to filing is if it is merely a hobby or an income-generating endeavour.

"If your hobby is, let's say baking or photography, but income is not regular and you don't really intend to generate income, you don't have to include it in your filing. If income is more regular, you can include it in your personal services income."

4. The ATO has practical advice for first-time taxpayers.

Mark shares that the ATO makes it easy for taxpayers to understand what they need to know regarding their taxes.

ALSO READ / LISTEN TO

Disclaimer: This article is for general information only. For specific financial advice, you should consider seeking independent legal, financial, taxation or other advice to check how the information here relates to your unique circumstances.