Key Points

- Experts predict that the rising interest rates will be a defining factor of the property market in 2023

- Skyrocketing construction costs or increased rental prices are expected to bring stability to the market.

Driven by the government's response to the COVID-19 pandemic and record-low interest rates, Australian housing saw a "dramatic increase" between 2021 and 2022.

But as the recovery from the pandemic began, RBA introduced new interest rates affecting the overall housing market and potential first home buyers.

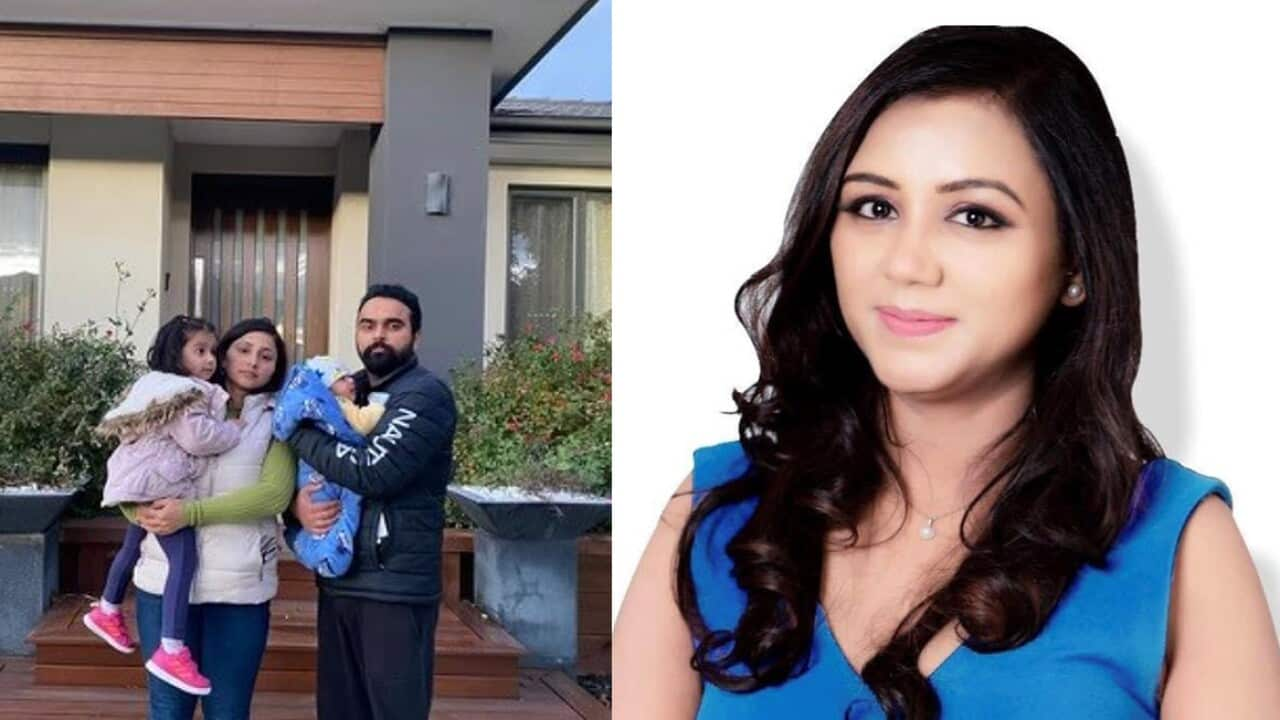

Seaford resident Satyajit Singh has recently got married.

He says he's now looking to buy his first property in Australia.

An aerial view of houses in Dandenong in Melbourne. Source: AAP / DIEGO FEDELE/AAPIMAGE

"But the surging inflation and the interest rates severely affected our borrowing capacity which resulted in the rejection of our loan aplication forcing us to re-think about our approach to our first home," Mr Singh says.

Experts have predicted that rising interest rates will have an impact on the property market and be a defining factor of the industry in 2023.

'The property market will stablise'

Sydney-based real estate expert Malwinder Pandher says that while interest rates may make it difficult for buyers, they will also bring stability to the market.

"The current interest rates are actually the average rates that we've always had, they were lower than normal during the pandemic, which obviously attracted more buyers and caused a surge in house prices."

Malwinder Pandher from Mountview real estate in Bella Vista NSW Credit: supplied

Mr Pandher adds that the trends indicate that the market will remain stable throughout the year.

"We work on the frontline of the industry so we often meet with both buyers and sellers, and are aware of their needs, which gives us an understanding of where the market is going."

"Be it interest rates, skyrocketing construction costs or increased rental prices, there are a number of factors that play a role in stabilising the market," Mr Pandher explains.

Hardeep Singh from Area Specialist Credit: Supplied

“The rental crisis with historically low vacancy rate and rising rents means more buyers in the market. People don’t want to pay the same rent as what they can use to pay mortgage repayments.”

“I believe that this year the market might see a bit of decline but remain stagnant, and people will continue to buy and sell the properties that are listed at the right price.”

Bidders look on during a property auction at Glen Iris in Melbourne. Source: AAP / DIEGO FEDELE/AAPIMAGE

LISTEN TO

Click on the audio icon to listen to this interview in Punjabi.

27:15