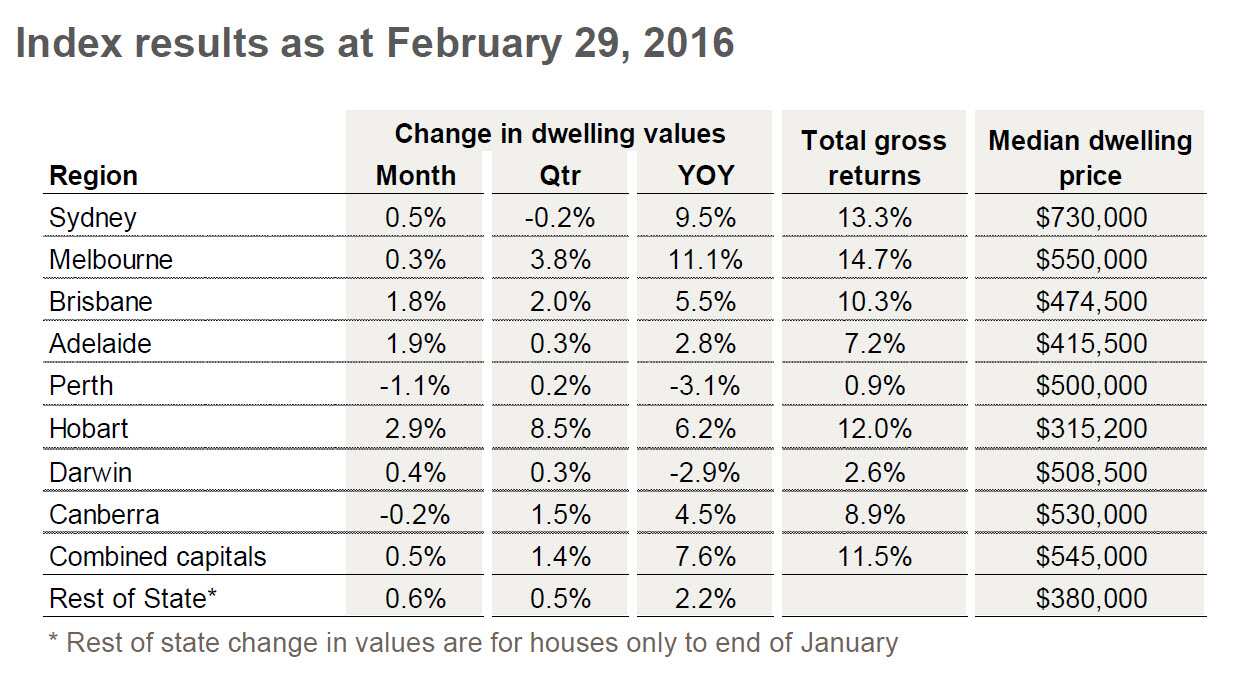

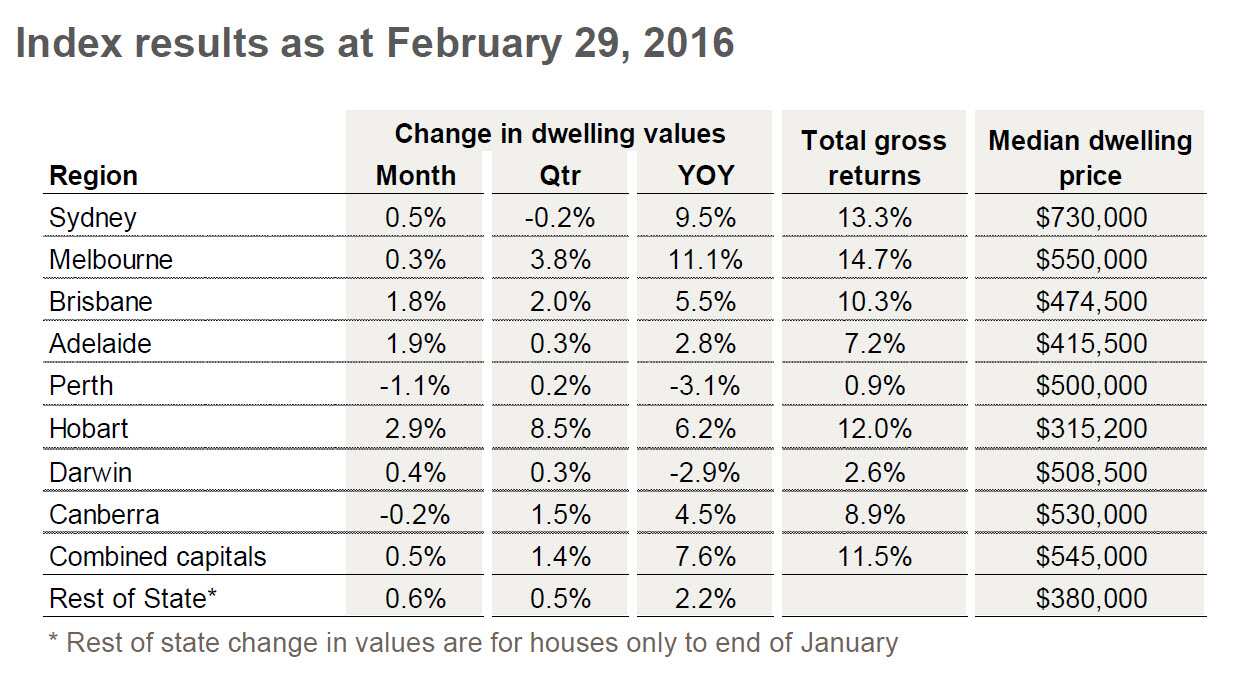

Capital cities' house prices recovered around the country in February with the exception of Perth.

Hobart performed best last month, up 2.9 per cent per cent, where median house prices, along with Adelaide and Brisbane, are below $500,000.

Tim Lawless, CoreLogic RP Data Head of Research says, the market is seeing a changing of the guard.

"It seems the more affordable capital cities - those which have under-performed Sydney and Melbourne over the past cycle to date - are now showing a stronger rate of capital gain," he said.

Sydney rose by 0.5 per cent in February, while for the year it's up 9.5 per cent - still below Melbourne, which for a second month in a row is the country's best-performing capital. Mr Lawless said a possible oversupply of inner city apartments in some markets will keep rents down.

Mr Lawless said a possible oversupply of inner city apartments in some markets will keep rents down.

House prices Source: CoreLogic RP Data

"We saw rental growth over the past 12 months at absolutely 0 per cent across our capital cities index," he said.

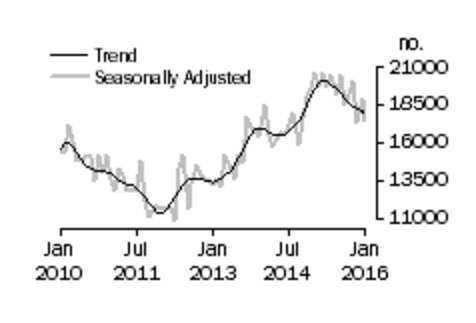

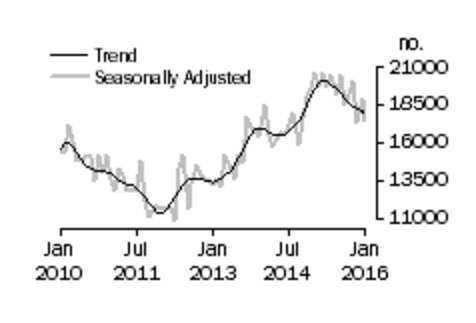

That supply is narrowing.

The number of dwellings approved to be built fell by a greater than expected 7.5 per cent in January, according to the Bureau of Statistics. A sharp fall in apartments, particularly in NSW, drove the decline. BIS Shrapnel Economist Frank Gelber said Australia was building the wrong stock in many cases, with larger, higher quality dwellings in demand.

BIS Shrapnel Economist Frank Gelber said Australia was building the wrong stock in many cases, with larger, higher quality dwellings in demand.

January building approvals Source: ABS

"The bulk of the growth in the market now is the over 35s, which are upgrading from smaller apartments as they have children," he said.

In its decision to keep official interest rates on hold today, the Reserve Bank noted risks were being contained in the housing market and that there were reasonable prospects for continued growth in the economy, with inflation close to target.

"The falling Australian dollar is the saving grace for Australia," Mr Gelber said.

Manufacturing activity is now at a six-year high, according to the Australian Industry Group.

Agriculture, education, finance and business services are also getting a boost.

Mr Gelber said overseas visitors would also contribute.

"Foremost is tourism, and so people are saying it's strong, but you ain't seen nothing yet, there's a boom coming."

Mr Gelber said it was helping to slowly re-balance an economy once highly leveraged to the resources sector, which is having to work harder just to offset a dramatic fall of in mining investment.

"We're a low cost, high quality producer, so we're competitive and can maintain increasing exports."