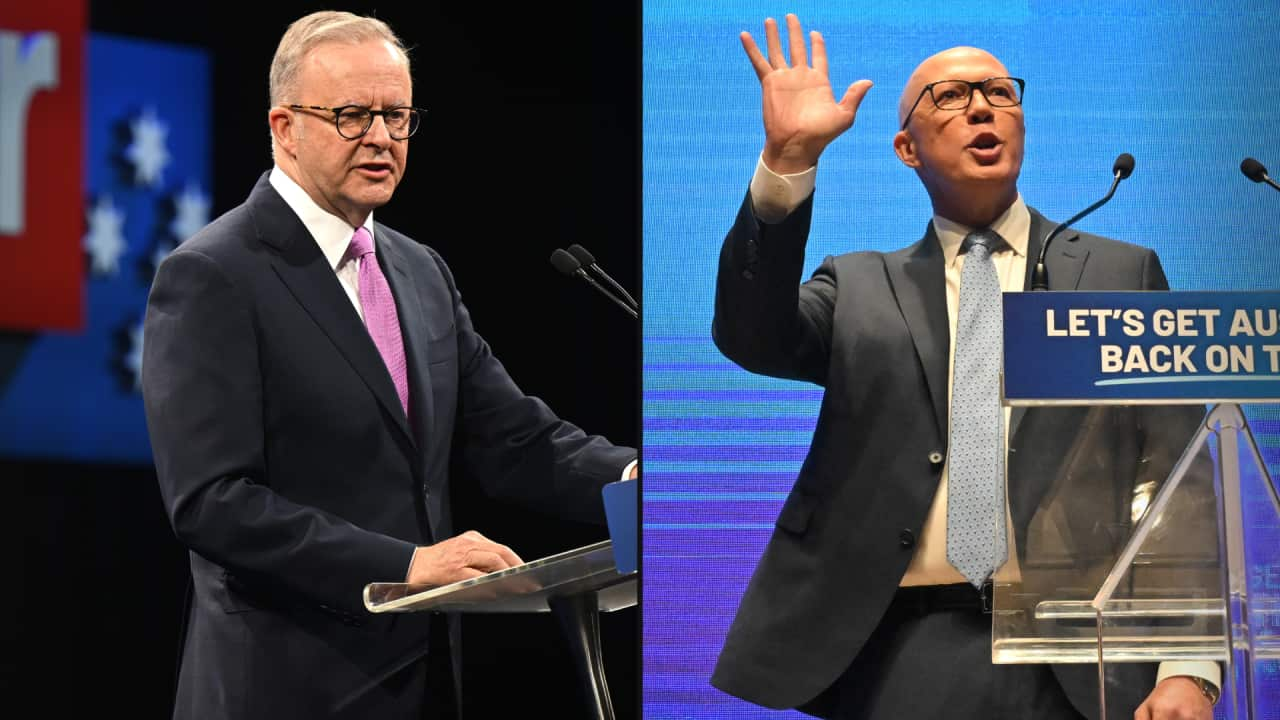

The major parties have used election campaign launches to focus attention on first home buyers, each unveiling pathways to enter the property market.

on Sunday committed to build up to 100,000 new homes and expand a scheme that allows Australians to buy a home with a 5 per cent deposit, if Labor is re-elected at the 3 May poll.

Meanwhile, unveiled a plan that would allow first home buyers to deduct mortgage interest payments against their taxable income.

Both leaders have pitched the plans as helping more people get on to the property ladder amid — but they're not without criticism.

Labor's plan: First home buyer scheme expansion and exclusive homes

A re-elected Labor government would expand the — which allows a 5 per cent deposit to purchase, with the government guaranteeing the other 15 per cent — to all first-time buyers. Participants would not be subject the lenders mortgage insurance, which can add thousands to the total cost oh a home loan.

The change would take effect from 1 January 2026.

"Young Australians are bearing the brunt of the housing crisis, and our government is going to step up to give them a fair go at owning their own home," Housing Minister Clare O'Neil said in a statement.

As part of the expansion, property price limits would be increased to average house prices in each city and region

Sydney's current property price limit of $900,000 would be increased to $1.5 million and Brisbane's would rise from $700,000 to $1 million. Victoria's capital or regional centres could increase from $800,000 to $950,000; Perth from $600,000 to $850,000; Adelaide from $600,000 to $900,000; and Hobart from $600,000 to $700,000.

Sally Tindall, the data insights director at financial comparison website Canstar, said the proposed expansion would put first home buyers on "a more even footing", those considering using it should be cautious.

Canstar said those purchasing with a smaller deposit could face higher interest rates, and the scheme would prevent them from renting out the property unless they secure an exemption. They would also remain subject to banks’ serviceability buffers, which are designed to stop borrowers from taking out more than their income can support.

Tindall said: "The scheme does nothing to address property prices, which is the biggest hurdle most first home buyers face."

Housing Minister Clare O'Neil said government-built homes will be cheaper than private sector built homes, but did not disclose by how much. Source: AAP / Mick Tsikas

In a statement, Labor said that in order to get projects moving quickly, states and territories would fast-track land release, up zoning and planning approvals.

Speaking with the ABC's Insiders program on Sunday morning, O'Neil clarified that government-built homes will be cheaper than private sector built homes, but did not disclose by how much.

"We will negotiate this on a state-by-state basis," O'Neil said. "But in the South Australian example, we are building homes that are affordable at the entry level of the market — somewhere between $500,000 and $600,000."

Labor says construction would begin in 2026, with buyers moving in from 2028.

The pledge comes as Labor faces pressure over its broader pledge to , although it maintains the target can still be met.

The Coalition's plan: Tax deductions on mortgage interest payments

The Coalition would introduce a first home buyer mortgage deductibility scheme.

It would allow first-time buyers of new builds to deduct the interest on the first $650,000 of their home loan for five years when lodging their tax returns.

There would be no cap on the property’s purchase price or the loan amount.

Under a Coalition plan, first home buyers purchasing new builds would be able to deduct the interest on the first $650,000 of their home loan for five years when lodging their tax returns. Source: AAP / Fabian Strauch/DPA

Once eligible, participants would retain access to the deduction even if their income rises.

It understood the Coalition would move to legislate the scheme within its first 100 days of government.

Maiy Azize, the spokesperson for national housing campaign Everybody’s Home, labelled the plan a "form of negative gearing for non-investors" which could drive up home prices.

"To make housing more affordable, we need to get rid of tax breaks when it comes to property, not create more," she said.

What do experts think?

Speaking to SBS News ahead of the launches, when media reports of the plans had begun to emerge, economist Chris Richardson described the proposals as "pretty dumb from both sides" and said they would make housing more unaffordable.

"Both sides are promising to give first home buyers more money, but more money isn't the problem," he said. "Our problem is not enough houses in Australia."

Also speaking ahead of the launches with Michael Fortheringham, managing director of the Australian Housing and Urban Research Institute.

Fotheringham said the easing of caps on the first home guarantee scheme was reasonable in light of current market conditions.

"There’s no point having a scheme that isn’t available to anyone because the caps haven’t kept pace with where property prices and household incomes are," Fotheringham said. "I think it's an appropriate ongoing adjustment."

He said the construction of 100,000 homes for first home buyers is the "bigger part" of Labor's announcement.

"This is a massive supply-side measure that focuses on building affordable housing, rather than financing it through third parties," Fotheringham said.

"Each state and territory will have their own ideas about what's appropriate. What’s built in Sydney will be different from what’s built in places like Dubbo or Geelong, so there will be quite a bit of variety."

He said he's optimistic about what this means for Australians in major cities.

"There'll likely be quite a range across the country, but I do think it will improve the diversity of housing stock in major cities."