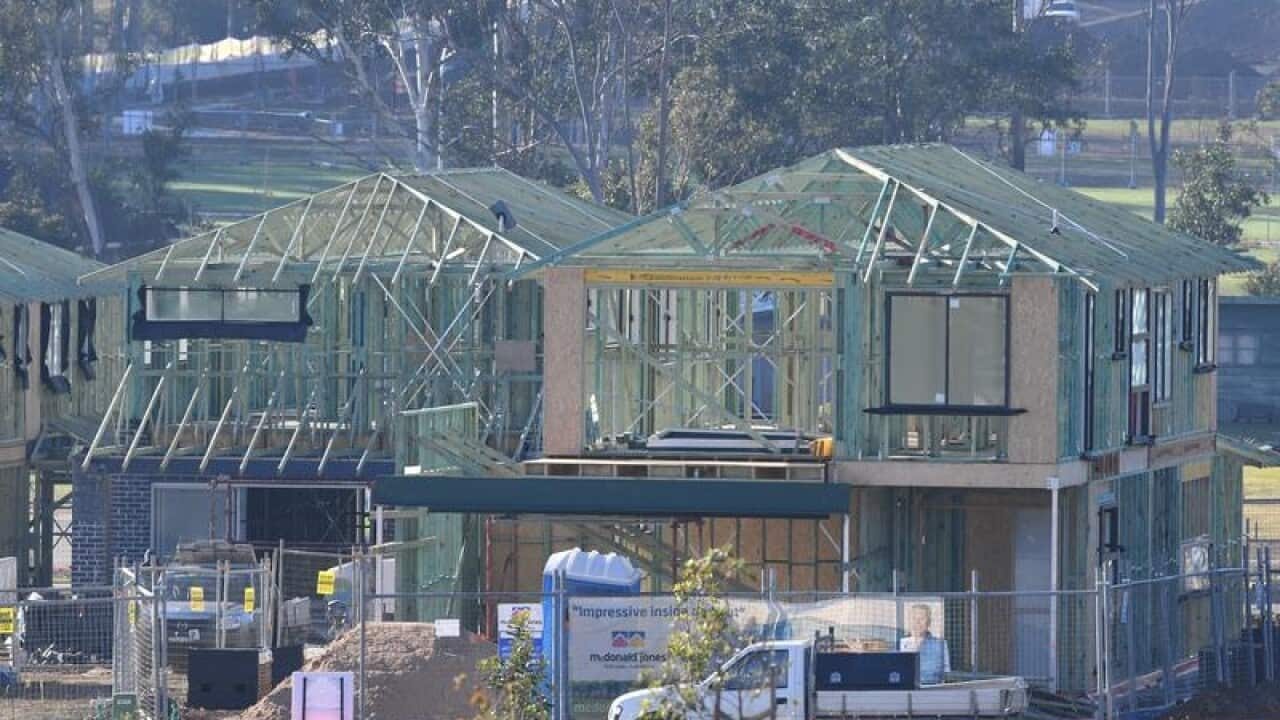

There appears to be no sign of a turnaround in the housing market, with tougher lending standards continuing to put pressure on loans for owner-occupiers, but weaker home prices are good news for first home buyers.

The number of home loan approvals fell by 0.9 per cent in November, Australian Bureau of Statistics figures show, which was better than market expectations of a 1.5 per cent fall.

The value of total housing finance in November was also down 2.5 per cent at $29.13 billion, with the value of new home loan for owner-occupiers down 1.4 per cent, and down 4.5 per cent for investor loans.

St George Senior Economist Janu Chan said weakness in the housing market will continue, particularly in Sydney and Melbourne.

She said weakness tend to be concentrated in the purchase of new dwellings, construction of dwellings and for investors.

However, Ms Chan say the pendulum is shifting toward first home buyers.

"The mix of home buyers is changing as the moderation in house prices attracts first home buyers to the market," she said.

"Additionally, incentives by (some) state governments have supported first home buyers in recent years."

St George says the proportion of first-home buyers are edged up from 18.1 per cent in October to 18.3 per cent in November, the highest in six years.

HIA's Principal Economist Tim Reardon said the figures reinforce the fact that the housing market is still easing back from the record activity of a few years ago, and will continue to do so in the coming months.

"The fall in lending in November is consistent with the decline over the course of 2018 and tells us that the volume of work builders have in their pipeline is continuing to fall," Mr Reardon said.

In the past couple of years the regulator imposed a range of restrictions on the market, such as limiting the size of interest only loans, but the Australian Prudential Regulation Authority lifted that restriction at the beginning of the year.

However, Mr Reardon says the easing of that restriction won' t result in an immediate turnaround for the housing market, because the impact on the crackdown in lending will be felt for some time to come.

"HIA research has found the time taken to gain approval for a loan to build a new home has blown out from around two weeks to more than two months" he said.