Key Points

- Australia has recorded its worst inflation outcome in more than two decades.

- Fuel, furniture and property prices have been some of the biggest contributors to the rise.

Australia has recorded its worst inflation outcome in more than two decades, paving the way for higher mortgage and lending rates.

Headline annual inflation jumped to 6.1 per cent year-on-year in the June quarter — the highest rate since the June quarter of 2001 when it rose by the same figure. It's also higher than the March quarter result of 5.1 per cent.

Fuel and property prices have been some of the biggest contributors to the rise in inflation, and blame has been laid on factors including the COVID-19 pandemic and Russia's invasion of Ukraine which have caused supply chain issues.

It comes as the Reserve Bank of Australia (RBA) has been hiking the official cash rate - which influences how banks set their interest rates - in a bid to curb inflation down to its 2 to 3 per cent target band.

Inflation has hit a high this century.

"The Reserve Bank of Australia is pressing on with its most aggressive tightening cycle in history, and the June-quarter inflation print will likely cement in a hike of at least another 50 basis points for August," Moody's Analytics said ahead of the inflation data release.

The RBA tips inflation to hike further and is expected to reach seven per cent by the end of the year.

The key word — inflation — has been at the top of the agenda in Australian politics this year. But what does it actually mean?

What does inflation mean?

Economist Matt Grudnoff, from the Australia Institute, described inflation as the "ongoing increase of prices".

"What's important is it has got to be the ongoing increase," he told SBS News.

"For example, if petrol prices go up as they have, that causes inflation. But if petrol prices stopped going up and flattened out, even at the higher level, then actually, that doesn't cause additional inflation. That's a one-off thing."

What causes inflation?

Mr Grudnoff said inflation can be caused by either supply or demand-driven factors. Currently, the war in Ukraine and the effects of the pandemic are causing supply-driven inflation.

"Inflation at the moment is being caused by supply chain issues," he said.

"During the pandemic, people swapped from buying services to buying goods because services often involved face-to-face interactions.

"Goods require transportation, whereas services don't. For example, if you go and get a haircut or you go to the movies, you travel to the place. But if you buy stuff, then that requires shipping, often from overseas.

"And so what happened was transport links got clogged up with the extra demand, and things slowed down, so they increased their prices.

Mr Grudnoff said rising oil prices have had a significant impact on the overall cost of living and the effects of climate change have also been a factor.

"Flooding in Australia has caused groceries — famously, lettuce — to also increase in price," he said.

Are there different types of inflation?

The term inflation can actually mean several things. For example, it can refer to the devaluation of a currency. But generally speaking, it's used to talk about the CPI.

"We tend to think about inflation as the Consumer Price Index," Mr Grudnoff said.

"That's the increase in the price of stuff consumers tend to buy and use.

Mr Grudnoff said the CPI only measures things that are consumed after being bought — not investments like property, adding: "If house prices, which are mostly driven by the increase in the price of land, are going up, that's not actually going to add to inflation at all, because it's not considered a consumer product, it's considered an investment."

Is inflation always considered a bad thing?

While inflation is often perceived as a bad thing, Mr Grudnoff said if it's not too high, it is a sign of a growing economy.

"Some inflation is good," he said.

"In fact, if we had no inflation, the Reserve Bank and the government would probably step in to try and stimulate the economy, because no inflation is usually associated with really slow or no economic growth.

"What we don't want is some large unexpected increases in inflation. That's when we get worried.

"But ongoing steady inflation is not a problem. And it's actually considered desirable."

What is the Reserve Bank and how does it deal with inflation?

The RBA is an independent central bank that is accountable to federal parliament. It regulates loaning rates for other banks. Mr Grudnoff said that, by adjusting interest rates, it can influence supply and demand which, in turn, deals with inflation.

He said it acts as the government's bank, is only able to deal with the government and other banks, and ensures the system remains stable.

"The most important thing, in terms of inflation, is they use monetary policy, which is increasing or decreasing interest rates in order to do a number of things," he said.

Mr Grudnoff explained that if the economy is doing well, there's lots of demand.

"If you've got a business, suddenly, you're getting lots of demand for your stuff. Labour begins to get tight, but people are still banging on the door wanting your goods, you'll tend to put your prices up," he said.

"If all businesses do that, we have inflation. So that excess demand is the thing that's driving inflation.

"What the Reserve Bank does is they put up interest rates.

"And, the increase in interest rates means that the portion of the Australian public that have a mortgage now have to spend more on their mortgage.

"They pay more interest, so they have less money to spend on everything else. So suddenly, they're demanding less stuff.

"So the time when demand is growing and causing inflation, the Reserve Bank brings in interest rates to try and reduce that demand, and therefore reduce that inflation."

So effectively, increasing interest rates decreases demand in the economy.

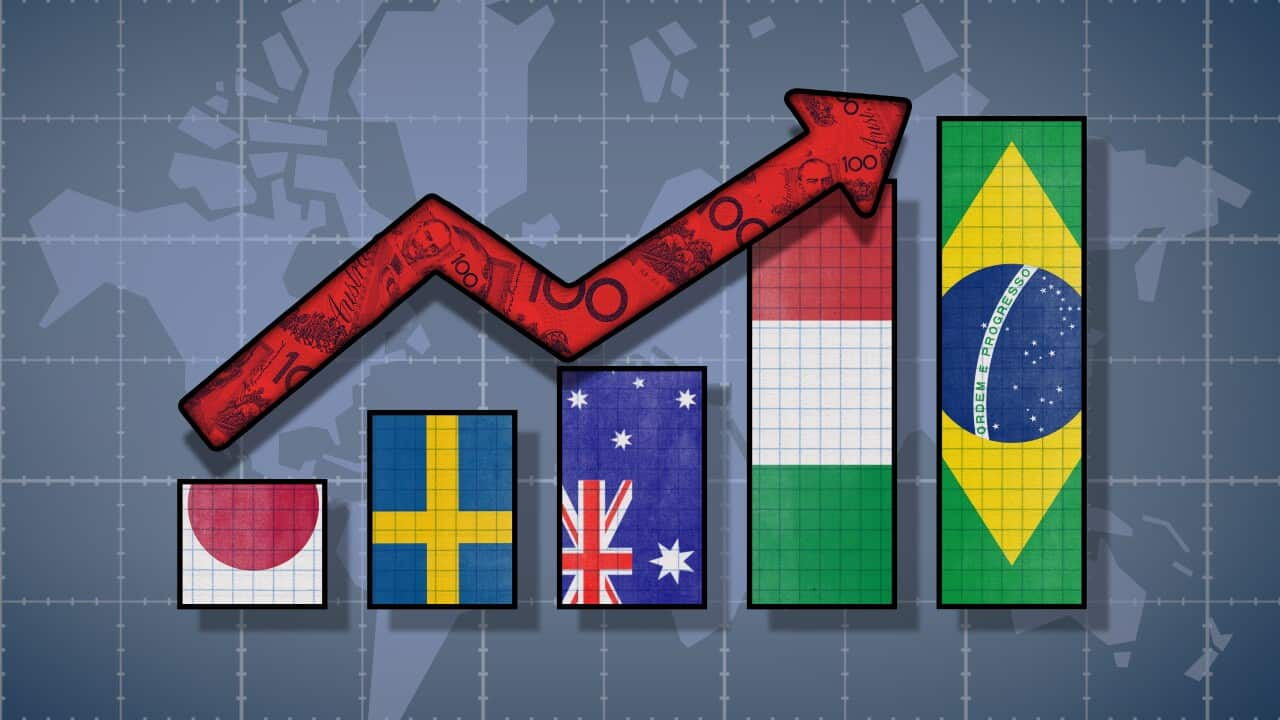

How is Australia comparing to other G20 countries?

While Australia's levels of inflation are high compared to the country's recent history, Mr Grudnoff said inflation is relatively low compared to other countries in the G20 who are also dealing with the impacts of the pandemic and war in Europe.

The G20, or Group of Twenty, is an intergovernmental forum comprising 19 countries and the European Union (EU). It works to address major issues related to the global economy, such as international financial stability.

"If most of the inflation has been caused by these kind of world shocks, it's not a surprise that most countries are experiencing high levels of inflation," Mr Grudnoff said.

Inflation in the G20 runs from 78.6 per cent to 2.3 per cent.

"Most of the G20 are actually higher than us. So we don't have as stronger inflation as the rest of the world."

"But if you look back over Australia's history, inflation is quite high at the moment. For quite some time, we've kind of been used to inflation between about, over the last 10 years, less than 2 per cent.

"Supply shock inflation usually has a one-off effect on inflation. So, if the oil price goes way up, and petrol prices go up, and then they stop going up, because there's nothing driving them further, you have a spike in inflation.

"But then it goes away, because there's nothing to push that inflation ever higher.

"So there might be a very good argument at the moment that the Reserve Bank doesn't need to react particularly strongly to this kind of inflation.

"This inflation will actually wash its way out by itself."