The May budget’s changes to superannuation will affect women over the age of 65 the most, new research from NATSEM suggests.

Changes in the 2016-17 Budget have lowered the threshold for paying tax on superannuation contributions.

from the National Centre for Social and Economic Modelling (NATSEM) says the changes will discourage some people from making voluntary contributions to their superannuation, particularly women aged 65 and older.

“What these results suggest is that this policy is going to discourage female workers aged 50 – 64 and 65 and over contributing concessional amounts to superannuation, mainly due to the proposed tax on concessional contributions over $25,000 per year,” the report says.

“This is because females in these age groups are earning a lower average income than males, so while males pay more as an absolute amount, females pay more as a proportion of their overall income.”

Part of the reason the tax changes affect older women more is because among the people affected, they have the lowest median income, according to the report.

The median income of affected younger people is higher than other age cohorts, because younger people will need to earn more before they can be expected to make contributions to their superannuation funds.

SBS has contacted Treasurer Scott Morrison for comment on the NATSEM modelling.

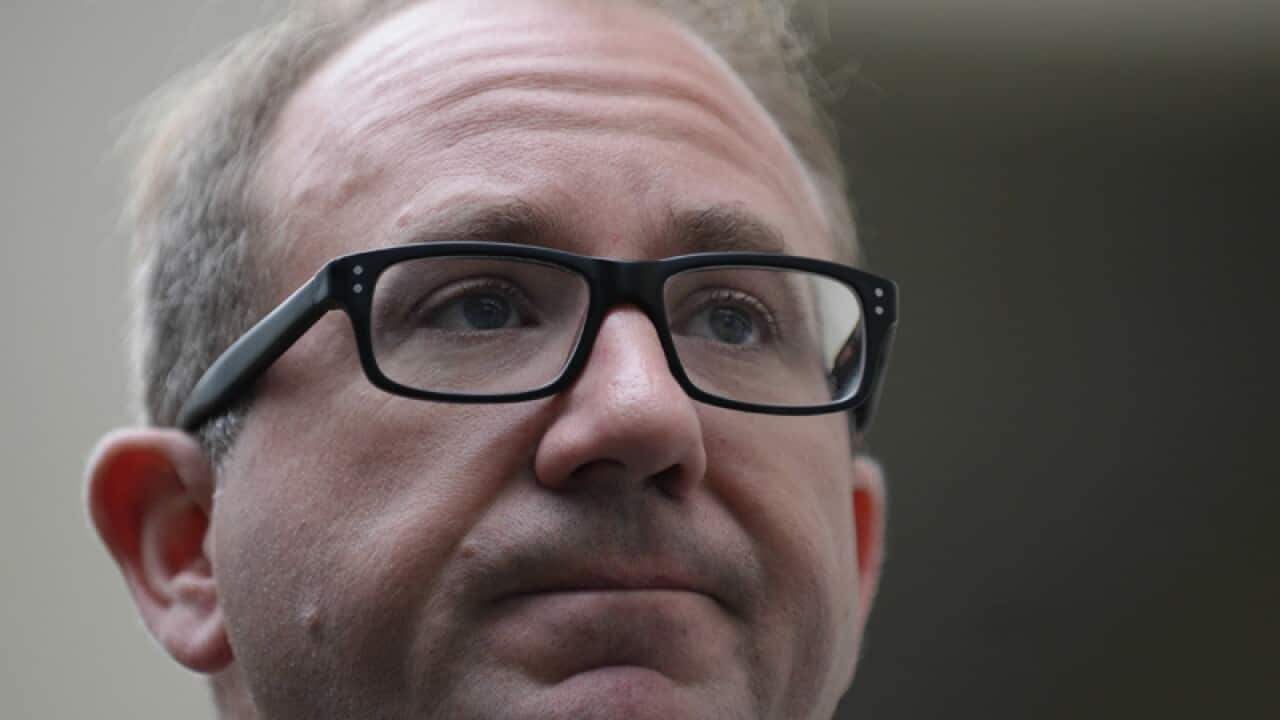

On Thursday, Labor’s alternative minister for superannuation Jim Chalmers would not comment on whether Labor would adopt the government’s measures in the May budget to lower the concessional cap to $25,000.

Mr Chalmers was talking on Sky News with David Speers, who asked Mr Chalmers what their policy on the concessional cap was, other than having consultations.

“I said today in that speech that you referred to that we are evaluating that policy against the Government's alternative, and that we're talking to people about it,” Mr Chalmers said.

Related reading

'Three days of humiliation' for Labor MP David Feeney