The database culled from the leaked files known as the Panama Papers reveals how some tiny countries in the South Pacific have been favoured as places to set up offshore trusts.

According to the database, there have been more than 13,000 offshore companies and trusts set up in Samoa, population 200,000, and nearly 10,000 in Niue, which has a population of just 1200. Some of the trusts listed are no longer operational.

It appears Samoa has become a more favoured destination in recent years after Niue implemented changes to its tax arrangements about a decade ago.

There are also more than 500 entities listed under the jurisdiction of the Cook Islands, population 10,000, and more than 600 in Singapore, population 5.7 million.

The International Consortium of Investigative Journalists made data on about 200,000 entities available at 5am AEDT on Tuesday on its website.

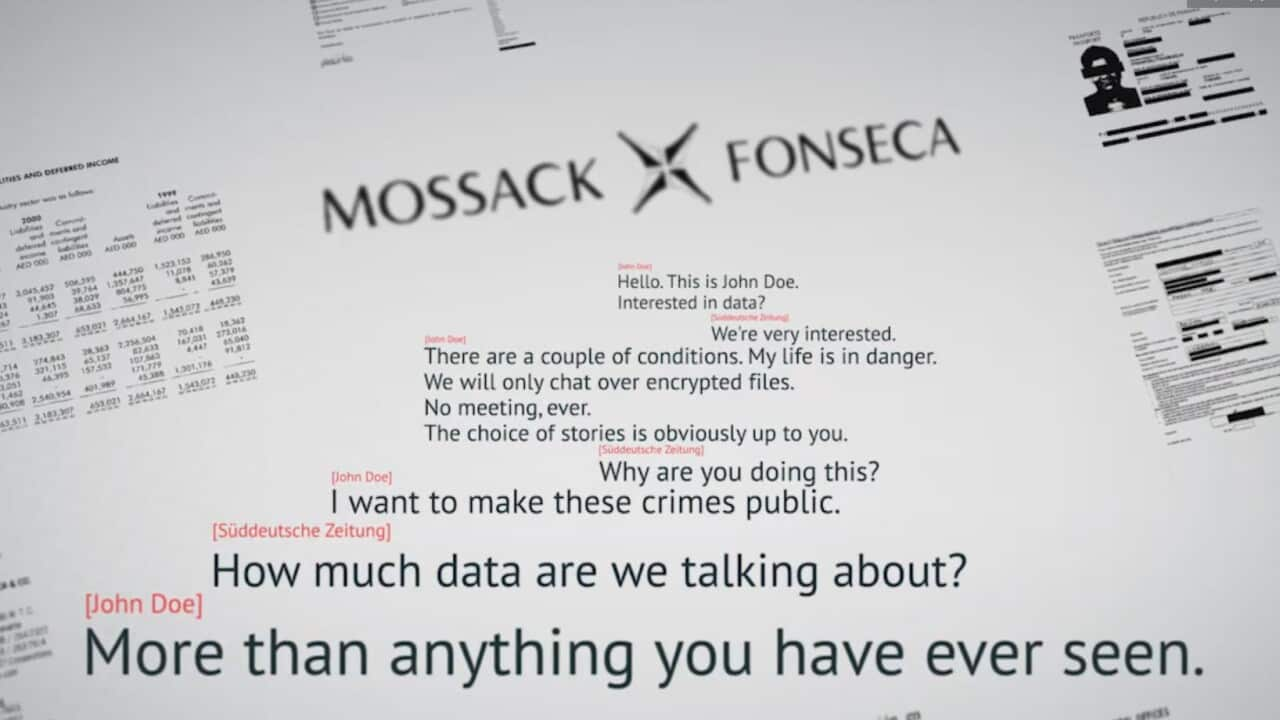

The data is culled from a massive trove of data on the finances of the rich and powerful that has become known as the Panama Papers.

They contain basic corporate information about companies, trusts and foundations set up in 21 jurisdictions including Hong Kong and the US state of Nevada. The data was obtained from Panamanian law firm Mossack Fonseca, which said it was hacked.

Investigative journalists mining the leaked data trove also say the law firm had ties to dozens of Americans accused of financial misconduct.

The ICIJ reported on Monday that the activities of Mossack Fonseca included setting up offshore companies for people who had brushes with the law.

Setting up an offshore company is not illegal. But they can be used to hide money from authorities.

The ICIJ said one "longtime customer" of the firm was a US financier later sentence to 17 years in prison for fraud. It said the firm set up an offshore company used by six Americans accused of running a Ponzi scheme that cost middle-class Indonesians millions.

Users can search the data and see the networks involving the offshore companies, including, where available, Mossack Fonseca's internal records of the true owners.

It won't be the full cache of the Panama Papers, since the database will exclude information and documents on bank accounts, phone numbers and emails.

The ICIJ said it was putting the information online "in the public interest" as "a careful release of basic corporate information" as it builds on an earlier database of offshore entities.

Setting up an offshore company is not by itself illegal or evidence of illegal conduct, and Mossack Fonseca said it observed rules requiring it to identify its clients.

But anti-poverty campaigners say shell companies can be used by the wealthy and powerful to shield money from taxation, or to launder the gains from bribery, embezzlement and other forms of corruption.

The Group of 20 most powerful economies has agreed that individual governments should make sure authorities can tell who really owns companies, but implementation in national law has lagged.

The data cache, first leaked to Germany's Sueddeutsche Zeitung daily, showed offshore holdings of 12 current and former world leaders.

Hundreds of economists urged world leaders on Monday to end the era of tax havens, arguing they only benefit rich individuals and multinational corporations and serve to increase inequality.

The 300 economists, in a letter co-ordinated by activist group Oxfam, say poorer countries are hit hardest by tax dodging.

Australia's Taxation Office is investigating about 800 Australians in relation to the Panama Papers.