TRANSCRIPT

In a cost-of-living crisis, having even a base understanding of money and financial systems can be critical to planning a secure and successful future.

Not only does financial literacy offer financial wellbeing and security, it also protects from the ever evolving threat of online scams.

Despite growing cost of living concerns, a new study from the Financial Basics Foundation says culturally and linguistically diverse young people in Australia may be falling behind.

Katrina Samios is the CEO of the Financial Basics Foundation. She says despite efforts to improve financial literacy, research indicates culturally diverse young Australians face additional barriers.

"Given that Australia's education and finance background is grounded in Anglo-European traditions and perspectives, we thought it was really important to understand what was happening for young people from CALD backgrounds. And the study found that they may be disadvantaged being from diverse cultural backgrounds. So the study aimed to understand and learn about these personal differences. We know that cultural backgrounds have an impact on behaviours and attitudes shaped by beliefs towards money, strongly influence, and individuals financial behaviours."

The Adjusting to Australian Personal Finance systems report focuses on 18- to 24-year-olds in Australia who were either born overseas and whose first language was not English, or whose parents were born overseas.

More than one quarter of Australians were born overseas (27 per cent) and close to half of the population have at least one parent born in another country (48.2 per cent).

With previous studies indicating financial literacy is an issue among young people in general, researchers say extra barriers faced by culturally diverse young people are widening that gap.

Study leader researcher Dr Laura De Zwaan says there are not enough reliable and accessible resources for people seeking out financial advice.

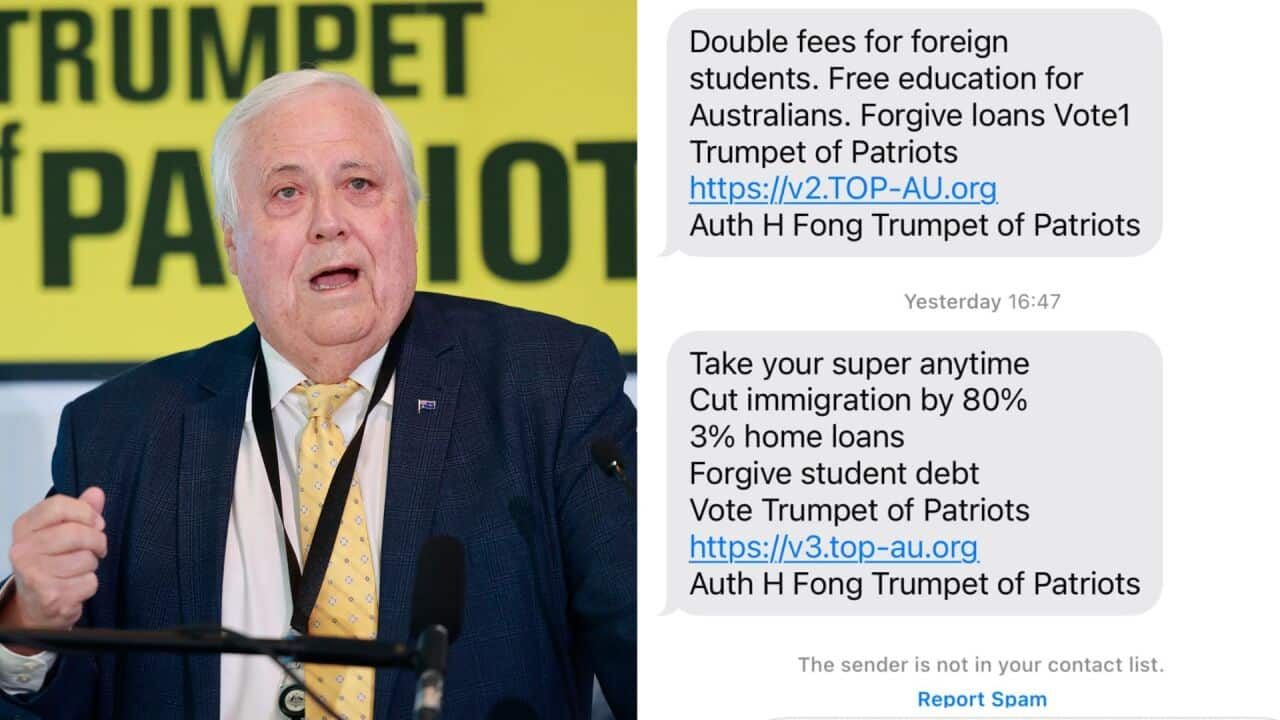

"So we do see that they're fairly independent in terms of trying to find information. So they will try, often it's the parents, but if the parents are in another country, they may not be available; or their knowledge might not be relevant to the Australian context. So they will reach out to usually their online communities to try and get information: Facebook, YouTube. And they'll start going into social media to try and get information. And once it moves away from their friend group and people they know and trust, that's when the information - the quality of it - is questionable. And so they can't necessarily verify that."

Among the barriers identified in the study was the potential language barrier.

Many participants in the study say they've had difficulties understanding Australian banking and financial terms like interest rates and superannuation.

As well as disconnecting them from the information, complex language can also make it difficult for people to discern credible sources from potential scams.

Dr Laura De Zwaan says it can be difficult to identify a scam when you aren't sure how to verify information.

"So some of the problems can be that they then do fall into scams because they don't have the ability to necessarily verify the information that they're getting. Obviously, there's language barriers there. In our personal finance system, we have a lot of lingo or jargon that isn't necessarily translatable and there can be some issues around even the currency and trying to understand the different values of things. So that can be a barrier as well."

Participants also spoke about the gaps between cultural expectations and the realities of the Australian financial landscape.

Many say they have turned to outside sources for financial advice, noting that advice from family members who grew up abroad may not apply to a young person in Australia today.

Culturally diverse young people were also found to be alarmingly susceptible to email [[phishing]] scams, as well as underpayment and withheld entitlements by employers.

With many relying on social media for financial guidance, the risk of exposure to scams or workplace exploitation presents an even trickier landscape for young Australians.

"They tend to be in a more precarious employment position. So again, they may be in a position where they don't have secure income. And obviously again, it's about sources of information that are credible and relevant to them. So where they are seeking financial information from social media or potentially their friends, and they may not be able to discern what is credible and accurate that leads them to risk of, as I said, being susceptible to scams and potentially increased debt, increased personal debt, and often insecure income streams."

The study found culturally diverse young people may gravitate to buy now pay later schemes to manage spending, with participants reporting they have often ended up paying more for a purchase due to late repayment fees.

Some participants spoke about a lack of understanding around how buy now, pay later schemes are a form of borrowing money, creating extra risk for less cautious spending habits.

Among the participants was 19-year-old international student Tanya.

Born in India, Tanya says she did learn about financial literacy there, but acknowledges it can be difficult for international students to adjust to how expensive life in Australia can be.

"I think with the international students, what the main problem is, obviously they are the same as the culturally, the culturally people like, let's say, Australians. And when they come to a completely different country, they absolutely have somewhat idea about finance, and then they have to deal with everything on their own as well. So I think that creates a bit more issue for them and gives them (requires) a bit more time to adjust than what a person with financial knowledge would take."

Without adequate financial literacy, the study says young people from culturally and linguistically diverse backgrounds are more likely to experience delayed financial independence.

Tanya says her parents taught her how to save and manage money, but that cultural differences meant some of that advice was not applicable in Australia.

"Back in India, we are not supposed to work until, like, we are somewhat adults, or somewhat young adults. So I did not work. I did own a business, but that's completely different, and we never pay rent. Like I used to live my with my family. So I did not pay rent. I did not pay for my expenses. So managing those things were a bit difficult when I came in Australia, because I had to do everything on my own."

Left unaddressed, poor financial literacy can contribute to financial stress, poverty and generational wealth inequality.

As well as identifying the barriers and potential outcomes of poor financial literacy, the study also makes several recommendations for intervention.

Among the proposed interventions is the provision of culturally sensitive, youth-oriented information on banking websites and apps, as well as the creation of moderated digital safe spaces for people to seek out information.

Dr Laura De Zwaan says financial advisors are often not accessible, affordable or appropriate for helping culturally diverse youth navigate the system.

"The big one that all of our participants were really seeking is youth-oriented information that's relevant to them. So they do seek out information and they're finding things about mortgages and accessing the equity in their home, and that's not relevant to their situation. So that's when they start to look for other information that is, and they'll go to social media for stuff that's targeted to young people. So we really do need that youth-oriented information. But it also needs to be culturally sensitive, so there needs to be less assumptions about their backgrounds and that they are financially independent and that they will know certain things."