TRANSCRIPT

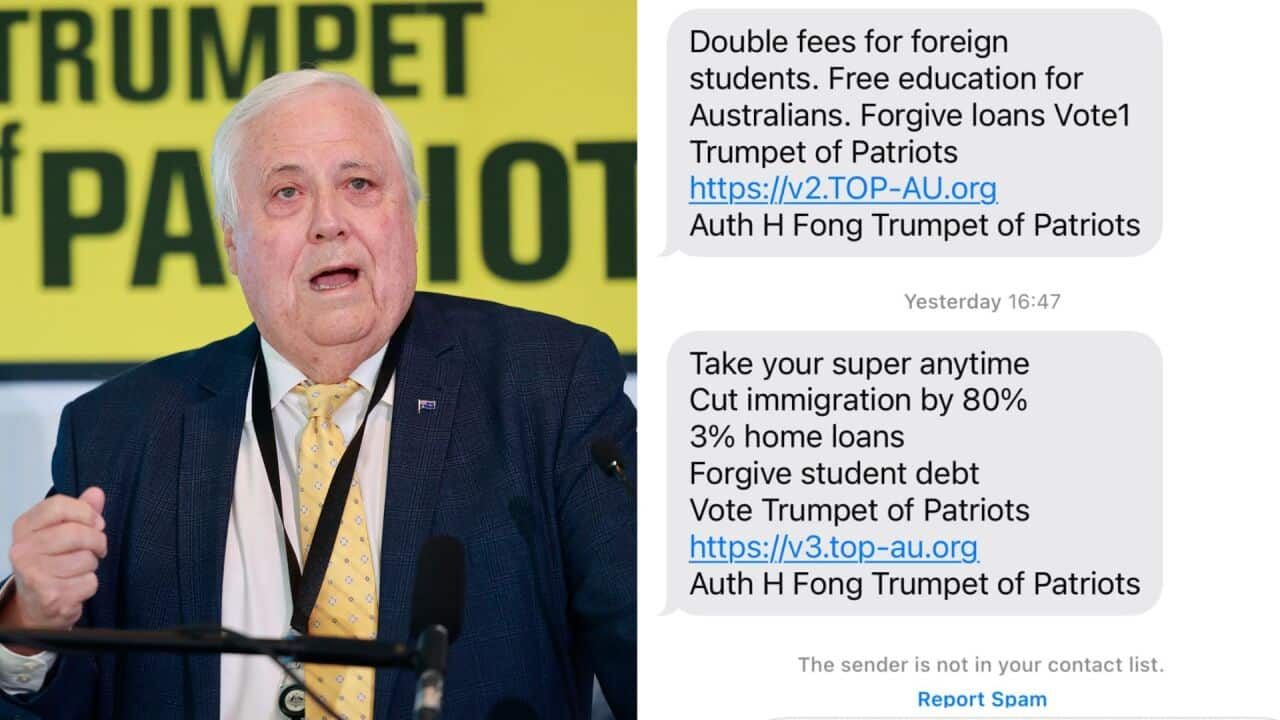

Education has been pushed to the forefront of Labor's pitch to voters, as the Albanese government prepares for an upcoming election.

Education Minister Jason Clare has made no secret of their desire to see Australians skilled up.

"Under Bob Hawke and Paul Keating, the number of kids finishing high school jumped from about 40 per cent to almost 80 per cent, and that was nation changing stuff. In the Budget we set a new target, that by the middle of this century 80 per cent of our workforce won’t just have been to school and finished school, but have been to TAFE or university as well."

It's an ambitious goal.

But for some students, there are financial considerations around how that education is paid for.

Most TAFE or university courses have a particular cost - and for graduate Rakelli Albino, it's about deciding if taking on a HECS debt is going to be worth it, if you cannot pay upfront.

"It's kind of like a never-ending cycle of - you want to get a job. You want to study for whatever reason: if you just want to broaden your knowledge or for job prospects. It still costs much more in the long run. You have to consider if it's even worth it to go to university."

The HECS system has attracted an increasing amount of criticism over the last few years, especially in 2023, when the indexation - tied to the consumer price index and the rate of inflation - jumped seven per cent.

Independent MP Monique Ryan said earlier this year that this highlighted the unfairness of the system, where debt accrued faster than a person's ability to pay down the balance, because indexation is added before the repayments - taken through the tax system - are applied to accounts.

"2.9 million Australians have a HECS debt. That's one in ten of us. And those people carry that debt for decades... So, if you're an average Australian now finishing a degree and you're earning $60,000 a year and you've got an averaged sized HECS debt, your HECS debt increased last year after the repayments that you made."

Bruce Chapman is an Emeritus Professor of Economics at the Australian National University and regarded as the architect of HECS.

He said in May this year that the idea of indexation is in itself reasonable.

"It's fair for a government to index the debt. Because the government has brought the students something, which is a university place, and it cost taxpayers money at the time. And over time of course the costs go up, so to index the debt is one way of making sure that the government gets back close to what it laid out."

But he has maintained that the politics is a different story.

Under pressure from critics, the government has promised a change to indexation, pledging legislation to decrease the rate applied last year.

The Greens though have lobbied for student debts to be eliminated altogether, with Senator Mehreen Faruqi arguing that charging people to study is fundamentally unfair.

"All student debt should be wiped and uni and TAFE should be free. This is a start but, if Labor can wipe 20 per cent of the student debt, surely they can wipe it all."

The government has declined to accept the Greens' position.

But it has come up with a second plan: a 20 per cent cut in HECS debts in 2025 which would wipe an average of just over $5500 off the HECS that's owed in that financial year.

And Anthony Albanese has revealed there's a third kicker:

"We will raise the repayment threshold, from 54 thousand dollars up to 67 thousand dollars. We will lower the rate of repayments, and we will index both to keep them fair into the future. Now this means that if you are earning 70 thousand dollars, you will save 1,300 dollars a year in repayments."

Not everyone is happy with these announcements.

Opposition spokesman Simon Birmingham says it's a cynical political ploy.

"This isn't real reform. This doesn't change the student fees that somebody who starts uni next year pays. This is simply a cash splash from Anthony Albanese, an attempt at trying to con or hoodwink an electorate ahead of an election."

The Greens are also unhappy - because South Australian senator Barbara Pocock says there is nothing stopping the government from seeking parliamentary approval now.

"We say to the Albanese government: let's do this now. Let's not defer this until after the election. Students need relief now. And we in the Greens are willing to move straight away to make this possible this year."

But economists say the bigger picture also needs to be looked at.

Some like Chris Richardson say changes to funding of the tertiary sector could worsen inequalities already present within the tax system.

"Somebody always pays. This is essentially a tax cut - but only if you went to university. And ultimately that gets paid for by the people who didn't go to university. Given that some student debt is never repaid anyway, the people who are the least financially successful - this is quite a sharp subsidy from the less well off to the better off."

Others point to inequalities in terms of gender.

That's because women tend to be enrolled in courses that cost more and ultimately pay less in future careers - and have their work lives and ability to repay interrupted by caring responsibilities.

Bruce Chapman says the different fees are not reasonable.

"We've had differential HECS since 1997 when the Howard government introduced differences. But the differences that came about in 2020 I think are about as unfair as you can get. They've charged humanities students - they doubled the charges for humanities students. Humanities graduates - particularly female graduates - are the lowest paid. They'll have the highest debts. And some of the most lucrative professions - medical specialty for example - are paying as a per year charge less than humanities. This is probably the single most important issue and problem with the current HECS system."

An increasing amount of research bears out the impact that higher education has between men and women.

Submissions to the universities accord inquiry - and separate academic studies - have suggested the HECS debt burden falls disproportionately on women.

Research published by Mark Warburton from the University of Melbourne's Centre for Higher Education Studies indicates the greatest amounts of student loan repayments were from female registered nurses, followed by female primary school teachers.

The Futurity Investment Group's Impact of University Debt Report meanwhile found that university educated females earned less and have more HECS debt than their male counterparts.

Bruce Chapman says he agrees with the recommendations of the recent Universities Accord that HECS repayments should be related to capacity.

"Do your best to charge students and graduates on the basis of their likely expected capacity to pay. HECS after all is an income contingent system, so it's driven by capacity to pay. So you don't want to have really high debts for people in low income jobs. The classic example is nursing, although it's not quite at the lowest. But humanities graduates paying more than medical specialists - this is really bad economics."

There's been little focus on the gendered nature of HECS policy in the general public debate.

But Rakelli says if the government are considering any further changes, they should take into account that people don't always pay off their education early.

"You're 18, 21, 22, you graduate uni. You've got $16-20,000. It doesn't really affect you until later on. For example if you're 30 ready to look for a mortgage, you're set back from something from so many years ago. And you don't have much control over it, paying back, and where your money goes."