TRANSCRIPT

Addressing the National Press Club, Prime Minister Anthony Albanese says he won't be following through on a promise he took to the election to proceed with controversial stage three tax cuts as legislated in 2018 by the former Coalition government.

“I recognise, as the Treasury analysis confirms, working households have experienced the fastest rise in their cost of living. That is why over summer, I ased Treasury and Finance to present us with options to help people with their cost-of-living whilst importantly continuing the fight against inflation. Australians are looking for more help. Australians deserve more help. And today, I can confirm that more help is on the way.”

From July 1, the tax cuts as legislated were set to benefit higher income earners the most, with a tax cut of $9000 a year for those earning $200,000 a year or more.

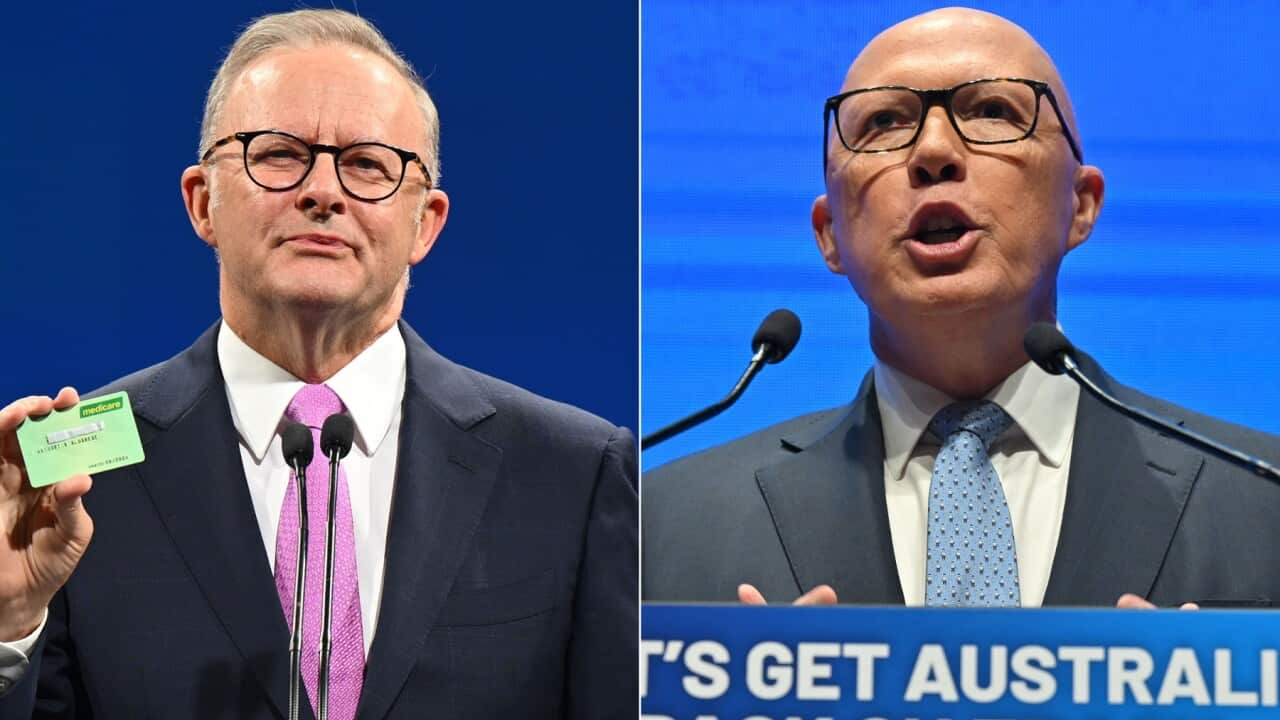

Mr Albanese says the Labor caucus has agreed to changes to redistribute the benefit of the tax cuts to favour low and middle income earners.

“Our government will deliver a tax cut for every single Australian taxpayer. All 13.6 million taxpayers. Everyone who works and who pays tax will benefit. This is a plan for middle Australia that delivers for every Australian taxpayer right up and down the income ladder. Helping with the cost of living, nourishing aspiration, and boosting participation.”

Under the changes, the tax cuts to take effect from July 1, will trim the size of the tax cuts by half for wealthier individuals earning $135,000 to $200,000 a year.

It will also apply a tax cut to those earning less than $45,000 - a group previously excluded from tax cuts under the original legislated stage three tax cuts.

This will be achieved by reducing the lowest rate of income tax from 19 cents in the dollar, down to 16 cents.

Workers earning $130,000 will receive a larger tax cut of $3,379 - an increase of $804.

Workers on $40,000, who were not set to get any tax cut, will now receive a $654 benefit.

The Coalition says going back on the commitment to keep the legislated changes is what it calls the "mother of all broken promises".

Opposition leader Peter Dutton says he wants to consider the details of the changes before he decides whether the Coalition would repeal Labor's revamped tax cuts.

“There are more questions than answers out of the prime minister today and we want to see all of that detail and understand whether he is lying or telling the truth because now. And you can’t believe a word that he says. I want to understand from Treasury whether it is inflationary because if it is - as many independent economists are pointing out - his announcement today will be to high interest rates or at the very least, interest rates remaining higher for longer.”

In his National Press Club speech entitled 'Middle Australia', Mr Albanese the economic situation is vastly different today than five years ago when the tax cuts were legislated.

“Australians have been living through the economic aftershock of the pandemic, the first recession in three decades; and the ongoing far-reaching consequences of Russia's invasion of Ukraine. An unprecedented combination of global inflation and damaged supply chains has pushed up interest rates, putting pressure on family budgets. Now everything we have done as a government has been about managing those competing forces.”

He says advice from the Treasury, that he plans to publicly release, also supports the changes - showing the new plan will not add to inflationary pressures because it is "broadly revenue neutral" on the federal budget.

The prime minister says the Labor caucus has also agreed on other measures to address cost-of-living pressures for households.

These include: a 12-month inquiry into the supermarkets by the Australian Competition and Consumer Commission, and changes to who is exempt from paying the 2 per cent Medicare levy.

Low-income earners will get additional tax relief of up to $172, as a result of changing the thresholds above which taxpayers are required to pay the levy.

Those who do not pay tax, including welfare recipients, will not benefit from the changes to tax cuts.

The Australian Council of Social Service's Cassandra Goldie says the changes to the stage three cuts are fairer and welcome - but she also called for action to help welfare recipients facing poverty.

“Let's remember, that about 30 per cent of people are on income so low that they are not within the income tax system. And this package, as it has been modified, it is definitely fairer - but there is a missing piece. And we will be calling on the government to fix that as quickly as possible.”

Greens leader Adam Bandt says he also welcomes the changes, but wants the government to go further in reducing the size of the tax cuts for the wealthiest.

“But why is Labor still giving politicians and billionaires a $4,500-a-year tax cut that is three times as much as what the average wage earner is going to get? Why is Labor expecting people to be happy with an additional $15 a week when rents have gone up by about $100 a week under Labor's housing and rental crisis. And mortgages almost $200 a week. Is this really the best that Labor can do in the middle of a housing, rental and cost-of-living crisis?”

Australia's biggest supermarket chain says it welcomed the opportunity to assist the the consumer watchdog with its inquiry.

In a statement, Woolworths Group CEO Brad Banducci says the company is aware "many Australian families are doing it tough" and are looking for relief.

He says food inflation is expected to ease throughout 2024.

After a failed Voice referendum, the Albanese government is also preparing for the next federal election to be held on or before 27 September 2025.

These voters shared how they're feeling.

Female voxie 1: I don't think I'll be voting for him again. So it's really hard to answer that question. I think we're just disappointed.

Female voxie 2: Wealthier people being able to keep their money and paying less tax. I don't really see how that benefits - or trickles down to low socio-economic areas. People who are just trying to survive the cost of living right now. For me, my concern more so is how it is going to impact low socio-economic areas.

Male voxie 1: I don't think he was given much of a fair deal to begin with. But starting from a low bar. Small improvements - but not enough. People are desperate for cost-of-living relief. And those new stage three tax cuts will definitely deliver that.

Male voxie 2: That's all very well, but what are they doing about the corporations and the multi-nationals, which are paying no tax.

Male voxie 3: He's a man not to be trusted. He's a failure as a leader. And I think the whole fiasco with Yes vote (at the Voice referendum) is the very thing that brings down this government. But anything that helps the litta fella, I'm all for that.

Male voxie 4: I think that's a good idea. I am a pensioner on a fixed income, so any break that I get like that is good.”