Three quarters of Aboriginal and Torres Strait Islander people are struggling with accessing financial services, new research has shown.

A new report, released today by First Nations Foundation and the Centre for Social Impact, examines the financial resilience of Indigenous people.

First Nations Foundation CEO Amanda Young said the report is the first snapshot into the financial position of Aboriginal and Torres Strait Islander people.

She said one in two Aboriginal and Torres Strait Islander people also reported experiencing financial stress.

“It tells us a very interesting story,” Ms Young told NITV News.

“Only one in 10 Indigenous people are financially secure, which is not a great report card.

“A figure I’m really focused on at the moment is that 75 per cent of Aboriginal and Torres Strait Islander people say they struggle with financial services.

“For us, it’s saying there’s a problem, but it’s one that we can fix.” 'Cultural responsibility'

'Cultural responsibility'

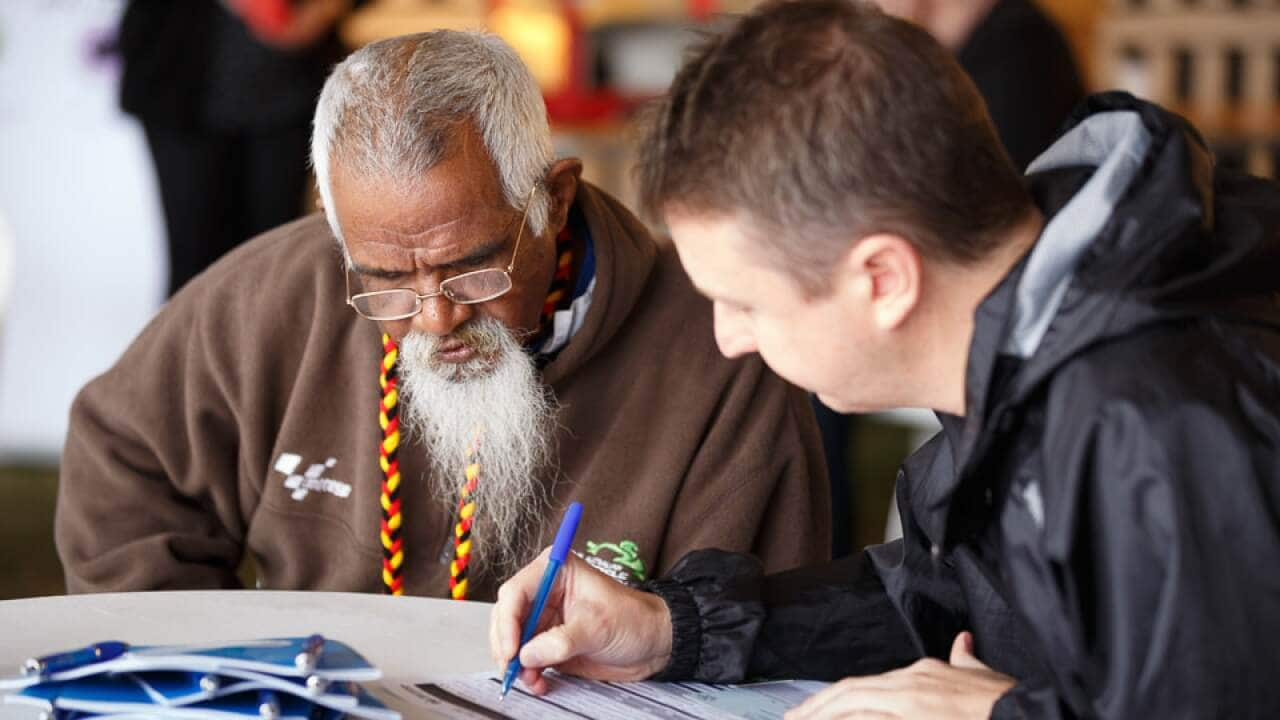

First Nations Foundation provides financial services to Aboriginal people all over the country

Another key finding of the report is that three quarters of Indigenous people are sharing their money with family and friends.

Indigenous Consumer Assistance Network (ICAN) senior financial advisor John O’Malley said this can be a problem, but there’s also cultural reasoning for it.

“We should not ignore it as a cultural responsibility,” he said.

“Often it’s like a barter - you give me money this week, I’ll give you money next week - but there’s an imbalance.

“There seems to be one person giving the money all the time and not receiving any money back.

“Before whitefellas came onto First Nations land, that barter system worked quite well in that sharing and equal sharing.

“Now, in a monetary term, it’s helped a lot of families but we see that on occasion there’s that imbalance.

“Education, and cultural education, around that is important.”

'We need action'

Mr O’Malley said the findings of the study are not a surprise to him, nor should they shock anyone working in the financial sector.

“For people to come out and say ‘this is a surprise’, I would be blown away,” he said.

“Where we’re at now is about action. We need action. We have the results. What we need now is a plan to alleviate these alarming stats.” Ms Young said there’s a range of reasons Indigenous people might experience financial instability.

Ms Young said there’s a range of reasons Indigenous people might experience financial instability.

"We're dealing with the genesis generation of Aboriginal and Torres Strait Islander people handling money," First Nations Foundation CEO Amanda Young. Source: AAP

“It’s only been the last few generations of Aboriginal and Torres Strait Islander people, since the 1970s who’ve been allowed to legally own anything and receive their wages in hand,” she said.

“That means we’re really dealing with the genesis generation of people dealing with money.

“No one gave Indigenous people financial literacy training so it’s just been ‘try and find your own way’.”

Mr O’Malley said high costs of living in remote areas also contribute to financial instability.

“Recently we got the price of a loaf of bread on Palm Island, in Queensland, which was $6.80, compared to a person living in Cairns who could get a loaf of bread between $1 and $1.50,” he said.

“Those influences impact a person’s control on the way that they conduct their budget.”

'Complete blank'

But it’s not just financial literacy among the Indigenous community that needs improvement.

Ms Young said financial institutions also need to better understand Aboriginal and Torres Strait Islander people.

“They have no idea how Aboriginal and Torres Strait Islander people are doing financially,” she said.

“Aboriginal and Torres Strait Islander people don’t have financial literacy and don’t understand how the economy works and how financial services work.

“At the same time financial services are a complete blank when it comes to Aboriginal and Torres Strait Islander people and what their needs are.” And the problem is not just isolated to remote communities.

And the problem is not just isolated to remote communities.

First Nations Foundation held a Big Super Day Out in Brisbane, helping Indigenous people find their superannuation

“Not every Aboriginal person lives remotely,” Ms Young said.

“You’d be surprised how many Aboriginal and Torres Strait Islander people living in cities struggle with financial services.

“They don’t know about products and services, don’t know what’s reliable, don’t know what risk is, what gain is, or understand how the system works.”