It’s no secret that Korean pop music, or K-pop, has taken the world by storm over the past five years. It's part of what the country calls the Hallyu, or Korean wave.

Over recent years, the wave has widened to include beauty and cosmetics products from the Asian country, which has signalled a rise in the number of brands and products available to Australian consumers.

In March, around 800 customers lined up for hours at Sydney's Queen Victoria Building for the official store opening of Korea's number one beauty brand, Innisfree. The brand is arguably responsible for some of the biggest cult products in the industry, and the Sydney store was their first on Australian soil.

The brand is arguably responsible for some of the biggest cult products in the industry, and the Sydney store was their first on Australian soil.

People lined up to enter the Innisfree store in Sydney in March Source: Innisfree

With the opening, Korea Cosmetic Industry Institute researcher Sung Min Sohn tells SBS Korean that the popularity of K-Beauty will only grow in Australia.

"Upon Korean leading cosmetic company, Amore Pacific, entered into the Australian market, we have started to make inroads into the Australian market,” he says. “I'm thinking that K-Beauty's popularity may soon reach that of the Australian market." He believes a “new Korean wave” is behind the growing popularity of K-Beauty across the globe.

He believes a “new Korean wave” is behind the growing popularity of K-Beauty across the globe.

Sung Min Sohn, Researcher of Korea Cosmetic Industry Institute Source: SBS Korean

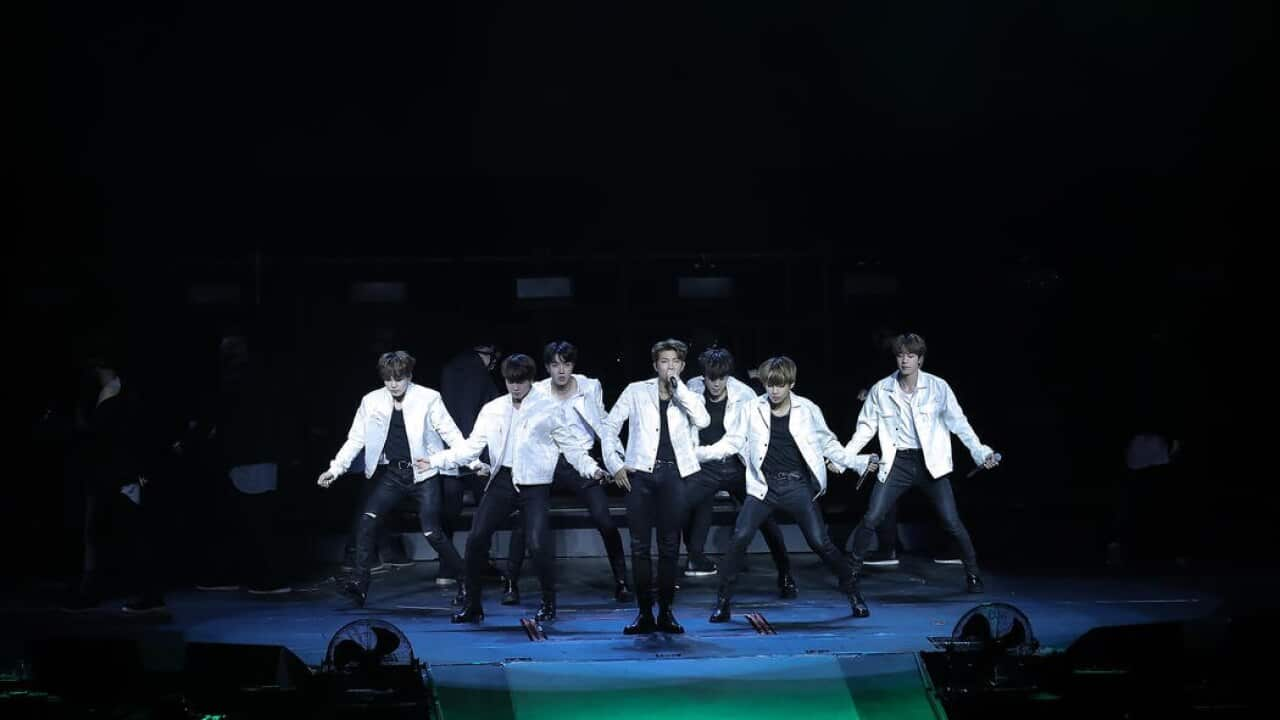

"While K-pop group, BTS, is a great contributor, consumers are starting to pay attention to K-Beauty as K-drama and K-movie has made quite a splash among international audiences," Mr Sohn says.

"The product's strength is very solid and the planning ability, development and composition are well matched. It seems that K-Beauty's ‘fun’ elements are harmonised and the K-Beauty trend has taken root."

But will K-Beauty rise to the same prominence of K-Pop in Australia?

SBS Korean attended the Consumer Goods Showcase Korea (CGSK) 2019 in Seoul in early June to find out more about K-Beauty and discovered that expansion into the Australian market was a common aspiration for many brands.

More than 1000 consumer goods companies and 600 distribution networks and importers of consumer good took part in CGSK. In 2017, exports of Korean cosmetics amounted to US 4.96 billion (AUD$7.1), more than four times that of the 2013 total.

In 2017, exports of Korean cosmetics amounted to US 4.96 billion (AUD$7.1), more than four times that of the 2013 total.

Consumer Goods Showcase Korea (CGSK) 2019 in Seoul, South Korea Source: Supplied

Based on 2017 export data, South Korea became the fourth largest exporter of cosmetics in the world, surpassing top cosmetic producers such as Italy and Japan.

However, the growing trend appears more evident when looking at the export-growth rates by country over the past five years where South Korea was the only country whose average annual increase exceeded 40 per cent.

Waiting at Australia's door

Woo Hyung Ahn, the vice president of VT Cosmetics told SBS Korean that the company was poised to enter the Australian market, with K-Pop mega group BTS as its ambassadors.

"Thanks to BTS, we are also receiving a lot of attention from abroad," he says.

"As BTS have become a huge sensation around the world, our company's image and recognition is rising as well.” Mr Ahn says the latest “Korean wave” represents only part of the reason for the rise in popularity of Korean cosmetics.

Mr Ahn says the latest “Korean wave” represents only part of the reason for the rise in popularity of Korean cosmetics.

Woo Hyung Ahn, the vice president of VT Cosmetics Source: SBS Korean

"It usually takes two to three years for famous foreign brands to develop and produce their cosmetic products, but Korean companies respond to consumers' needs very quickly," he says.

“We have the competitive edge of releasing a new product within even six months by quickly identifying customer needs and working hard to research, develop and produce.”

He says the Australian market was a very attractive one due to many factors.

"K-Beauty is also showing rapid growth in the Australian market. Korean cosmetics are expected to experience high growth in the market this year while the growth remains in the 20 per cent range," he says.

"Despite the worldwide economic downturn, the Australian market is very stable, especially in terms of disposable income, which is most relevant to cosmetics consumption, so the Australian cosmetics market is very attractive.

"It's also a very attractive factor that the female population of 18 years old and older is growing. Thus, we have developed a bold plan to enter the Australian market."

Nam-Ki Park, senior vice president of cosmetic powerhouse Amore Pacific, stresses his affinity for the Australian cosmetics market.

"(Australians) are investing more time and effort in skin care due to the impact of the climate environment where UV rays are strong," he says.

“There is a high level of awareness and affinity for K-Beauty with a preference for natural makeup based on healthy skin.”

Da Jung Im, assistant manager of the international business team of Joycos, a company preparing to enter Australia, says the Australian market represented “unlimited growth potential”.

"Australia is attractive because it has different seasons and climates in East and West, and South and North as well. The Australian market is a good market as various products can be marketable in various local markets,” she says.

"In order to penetrate the Australian market, it is more important to penetrate the micro market first using social media and digital platforms than to enter major markets." She stresses the importance of networking in the market and says: "In this new world, we must first think about how to be efficiently exposed and how people view and enjoy our products."

She stresses the importance of networking in the market and says: "In this new world, we must first think about how to be efficiently exposed and how people view and enjoy our products."

Da Jung Im, assistant manager of the international business business team of Joycos Source: SBS Korean

Coreana Cosmetics also values the Australian market, with representative Henry Kim saying that sun cream products were favoured by Australians.

"According to our Australian market report, Australians use sunscreen very often and UV protection is essential." says Mr Kim.

“In line with this situation, Coreana is trying to target the Australian market by creating sunscreen products that not only protects against UV rays but also blocks heat.”