More than 1,700 individuals with connections to Australia and a complex web of offshore companies set up in various tax havens been uncovered within the controversial Panama Papers.

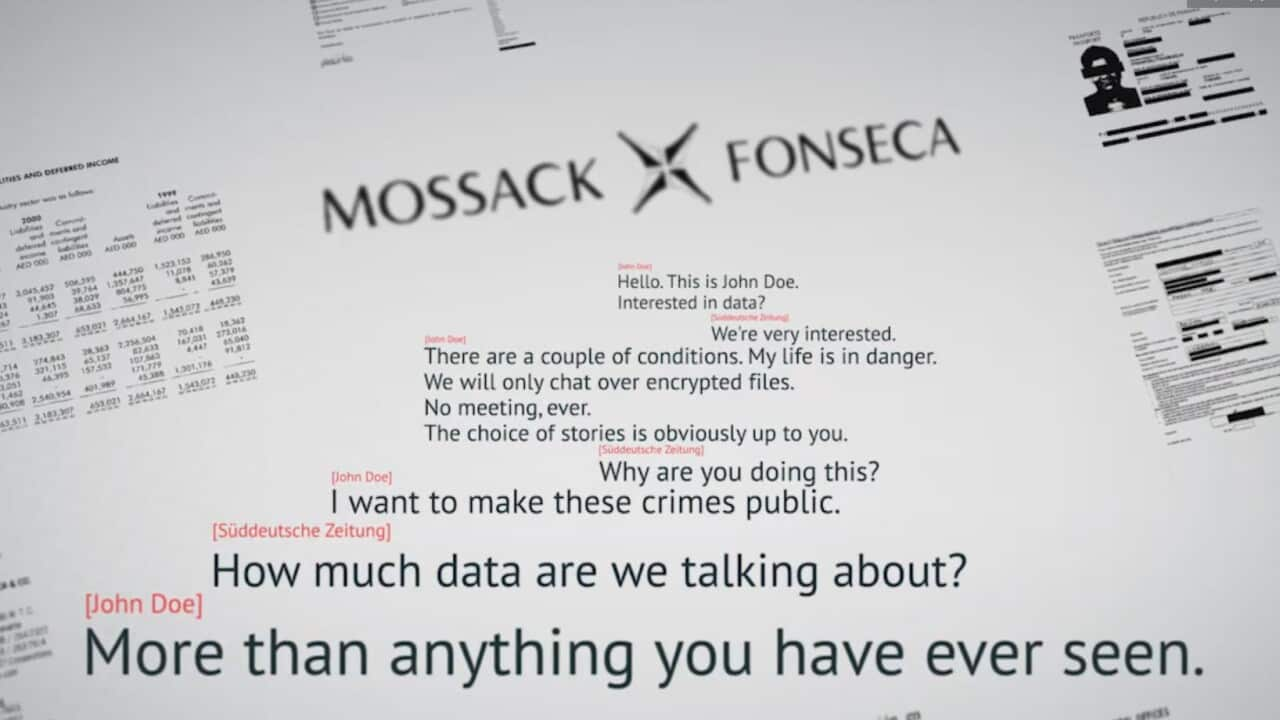

Their identities were revealed as an online database went live on Tuesday with details from a large chunk of 11.5 million leaked documents from Mossack Fonseca, the secretive Panama law firm that helps the rich hide their wealth.

The database shows that 118 of about 200,000 offshore entities such as companies and trusts set up by Mossack Fonseca have links to Australia, while 1,073 directors, shareholders and/or beneficiaries are listed as being either Australian or having some connection here.

Another 200 intermediaries - lawyers and other middlemen that help set up offshore entities - have connections with Australia, with 1,409 local addresses listed.

The database was set up by the Washington-based International Consortium of Investigative Journalists (ICIJ), which led the probe into the leaked documents that have sparked controversy around the globe.

When news of the leak broke in April, Australian mining giant BHP Billiton and security firm Wilson were among a bunch of companies identified as having links to Mossack Fonseca.

The documents also show that former Reserve Bank board member Robert Gerard was a shareholder of Mayfair Land Management, a firm set up by Mossack Fonseca in 2002 in the British Virgin Islands.

Mayfair was also listed as a shareholder in the Bahamas-based Gerard Corporation.

Mr Gerard quit the RBA in 2005 amid a battle with the Australian Taxation Office over offshore companies. He has previously denied any wrongdoing.

The database also shows some Australian stock exchange listed companies - including pet care and vet clinic chain Greencross as well as packaging giant Amcor - have had connections with Mossack Fonseca through intermediaries in Hong Kong and China.

The ICIJ has stressed there are legitimate uses for offshore companies and trusts.

"We do not intend to suggest or imply that any persons, companies or other entities included in the ICIJ Offshore Leaks Database have broken the law or otherwise acted improperly," it said.

The federal government in its budget last Tuesday announced plans to raise up to $4.35 billion over the next four years through a crackdown on multinational tax avoidance.

But ActionAid Australia executive director Archie Law wants the government and other countries to go further and introduce laws making company ownership transparent.

"Big business can currently hide all too easily behind the clouds of secrecy," he said.

"Global tax rules must change to stop big business using tax havens to avoid tax. That would involve all countries revising or cancelling their tax treaties with tax havens and introducing stronger anti-tax haven legislation."