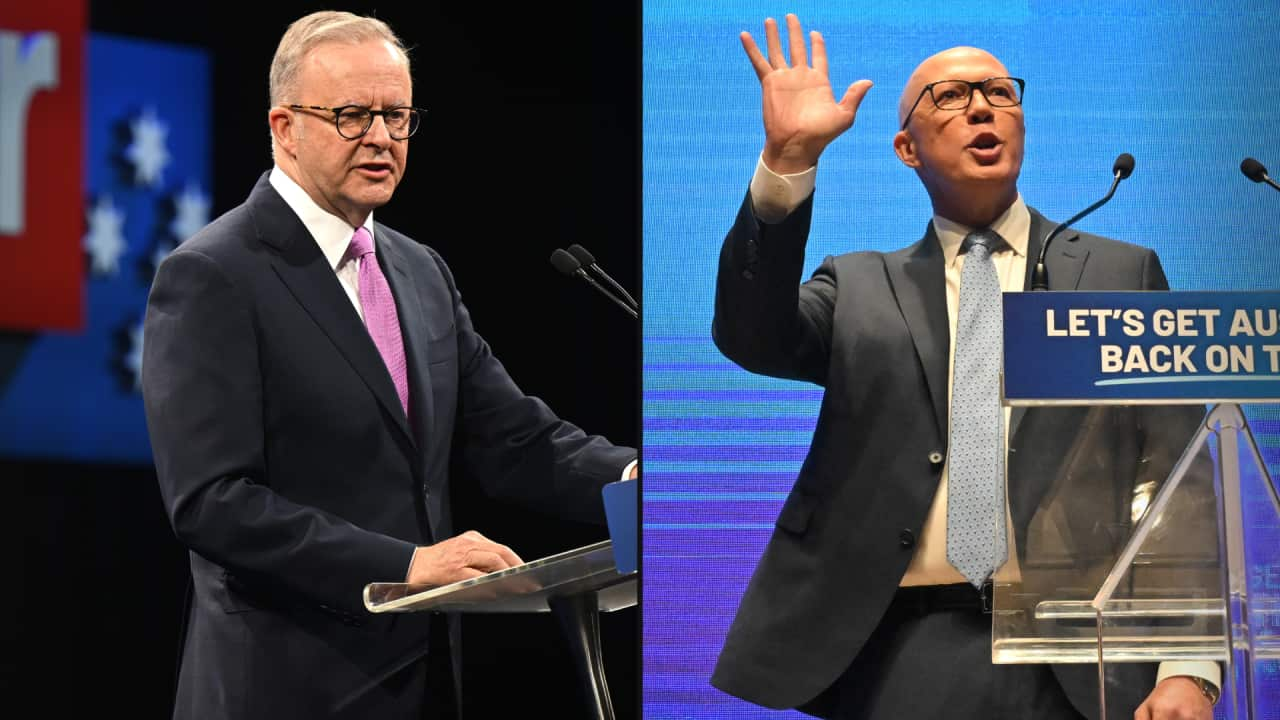

Economists and industry leaders have expressed concern over housing promises made by both Labor and the Coalition during the .

At the weekend, committed to expanding a scheme that allows first home buyers to purchase a home with a 5 per cent deposit; and said Labor would also build up to 100,000 new affordable homes for first home buyers.

Meanwhile, unveiled a plan that would make interest payments on the first $650,000 of a first home buyer's mortgage tax deductible for the first five years for those who purchase a newly built home.

Economist Chris Richardson described both parties' approaches as "pretty dumb", warning that their housing pledges would only worsen inflation and fail to address Australia’s housing affordability crisis.

Richardson added that property prices would likely continue to rise as a result of these promises.

"Both sides are promising to give us extra money … this doesn’t make Australia more prosperous. It’s just more money, chasing the same amount of stuff [and resulting in] prices higher than they need to be," he said.

How is housing affordability being defined?

Independent senator Jacqui Lambie also hit out at both leaders for failing to deliver on previous housing commitments.

"I mean, you’ve got to be kidding me," Lambie said in an interview on Channel Nine's Today on Monday.

"How about you turn the first lot of soil on the first 50 or 60,000 homes that you’ve promised?"

Labor's Housing Australia Future Fund to build 20,000 new social housing properties over five years from 2024 has been criticised for not yet delivering any new homes, although Labor has blamed delays in getting legislation passed on the Greens and Coalition.

Experts have also questioned the way housing affordability is being defined in the national conversation.

Liam Davies, a lecturer in sustainability and urban planning at RMIT, argued that many of the new schemes on offer are mislabelled as being aimed at housing affordability.

"They’re actually about 'accessibility'— we’ve just made it easier to get really big loans and that we call 'housing affordability'."

Two solutions for two different groups

Davies noted that the two major housing schemes target different demographics.

Labor is helping those without a deposit and the Coalition is focusing on those who already have one, but both face the same fundamental issue: a reliance on new builds.

Davies said the "devil in the detail" is that the policies are only for new builds.

"So it really depends on when those new builds are built, where they’re built," he said.

"If it’s just suburban housing on the fringe, that doesn’t really help."

He added that given the scale of government expenditure involved, there needed to be a longer-term strategy to ensure sustained housing accessibility and genuine affordability.

More support needed to keep up with demand

From an industry perspective, Property Council of Australia CEO Mike Zorbas welcomed the proposed injection of new builds as a "shot in the arm" but warned more support for local planning systems was needed to ensure supply could keep pace.

"Coupled with supply improvement policies, deductibility of mortgage repayments on new builds will help first home buyers who are watching their dream of home ownership slip away," he said.

"A stronger demand pipeline allows building businesses to plan for the future with confidence, translating to more new homes across the country and is a hedge against global uncertainty.

"Whoever forms government will need to apply additional direct incentives to boost state and local government supply and approval capacity, keeping the market in equilibrium, to build the homes the nation needs."

Labor and the Coalition defend their housing plans

Both major parties have backed their policies.

"On our advice, we're not expecting there to be a substantial impact on demand or on prices," Treasurer Jim Chalmers told ABC about Labor's 5 per cent deposit plan.

"We are extremely confident that this is a very responsible way to get more first home buyers into the market."

LISTEN TO

Who will make an impact, minor parties moves and the teal wave future

SBS News

29:05

He also noted the government had a $43 billion agenda and the primary focus was to build more homes.

Meanwhile Opposition leader Peter Dutton side-stepped economists' concerns his tax deductibility policy would only drive up prices and disproportionately benefit higher income earners, arguing it would help boost housing supply.

"It's going to encourage construction, which is really important," he told Seven's Sunrise program.

Correction: An earlier version of this story noted that Labor's policy to allow first home buyers to purchase a home with a 5 per cent deposit only applied if they bought a newly built or substantially renovated home. This is incorrect, the policy also covers existing homes.